How Volatility Affects E*TRADE’s DARTs

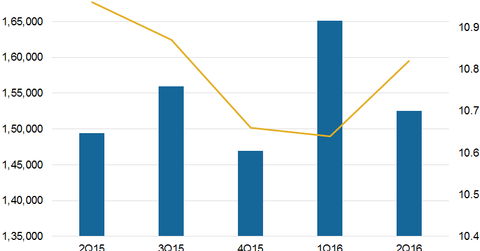

E*TRADE Financial reported DARTs (daily average revenue trades) of ~153,000 in 2Q16. The company’s DARTs fell 8% from the previous quarter and rose 2% YoY.

Oct. 18 2016, Updated 8:06 a.m. ET

Daily trades amid volatility

E*TRADE Financial (ETFC) reported DARTs (daily average revenue trades) of ~153,000 during 2Q16. The company’s DARTs fell 8% from the previous quarter and rose 2% YoY (year-over-year). The activity fell sequentially, as overall volatility fell marginally after the UK’s Brexit referendum. In 3Q16, daily trades are expected to have risen on increased volatility as markets have risen across the sectors.

Options formed almost one-fifth of the total daily average revenue trades—a level relatively consistent with the past couple of years. In July 2016, DARTs fell 1% as compared to trading in June. The company saw 17% of DARTs executed through mobile platforms.

Margin balances as of June 30, 2016, fell marginally to $6.8 billion. That’s 16% lower than the prior quarter and a rise of 8% over 2Q15.

Here’s how a few of the company’s peers in the industry performed in terms of revenue in the last fiscal year:

- Charles Schwab (SCHW): $6.5 billion

- Interactive Brokers Group (IBKR): $1.3 billion

- TD Ameritrade (AMTD): $3.2 billion

Together, these companies make up 16.1% of the iShares US Broker-Dealers ETF (IAI).

Commissions amid competition

E*TRADE’s average commission has risen continually over the past few years. In 2Q16, the company saw a rise in its average commission per trade to $10.82, as compared to $10.64 in the prior quarter and $10.96 in 2Q15.

In the second quarter, the company’s commissions, service charges, fees, and other revenues totaled $178 million. This amount was higher than the prior quarter’s $175 million.

Average commissions per trade expanded in the June quarter. This number was partially offset by lower DARTs while revenues expanded on commissions.