Assets, Rates to Have Pushed E*TRADE’s Bank Revenues Higher in 3Q16

E*TRADE Financial (ETFC) operates the federally chartered savings bank E*TRADE Bank. This structure has been deployed by many major brokers in the US.

Oct. 18 2016, Updated 11:05 a.m. ET

Banking model complements

E*TRADE Financial (ETFC) operates the federally chartered savings bank E*TRADE Bank. The structure has been deployed by major brokers in the US, which has helped improve services and generate interest revenues. The bank provides its customers with FDIC (Federal Deposit Insurance Corporation) insurance on a certain amount of customer deposits.

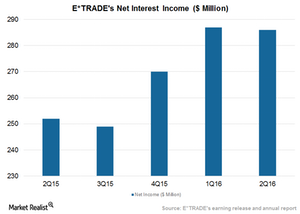

The bank invests deposit money primarily in low-risk securities such as agency mortgages. On a standalone basis, the bank generated net interest income of $286 million in 2Q16, as compared to $252 million in 2Q15. The bank’s net interest margins could improve as the Fed is expected to raise interest rates before the last quarter of 2016.

Here’s how a few of the company’s peers in the industry performed in terms of operating margins:

- Charles Schwab (SCHW): 34.4%.

- Interactive Brokers Group (IBKR): 45.4%.

- TD Ameritrade Holding (AMTD): 41.1%.

Together, these companies make up 16.1% of the iShares US Broker-Dealers ETF (IAI).

Strong balance sheet

As of June 30, 2016, E*TRADE, under the Basel III Standardized Approach, reported bank and consolidated Tier 1 leverage ratios of 7.5% and 8.2%, respectively. In the previous quarter, the company reported bank and consolidated Tier 1 leverage ratios of 7.8% and 8.6%, respectively.

Corporate cash ended the second quarter at $523 million, which is 9% higher than the prior quarter and well above its target of $100 million.

E*TRADE is gradually targeting client funds held in other banks to its own bank. The company is using its sweep platform for moving deposits on and off of its balance sheet at a quicker pace. This strategy helps the company manage a larger size of its balance sheet. E*TRADE aims to target a deposit base of $50 billion under its existing structure.