Must-Know: US HRC-CRC Spread Widens to Record Highs

During its 2Q16 call, AK Steel (AKS) pointed to a “significant rise” in CRC steel imports from Turkey, Vietnam, and Australia.

Nov. 20 2020, Updated 5:22 p.m. ET

HRC-CRC spread

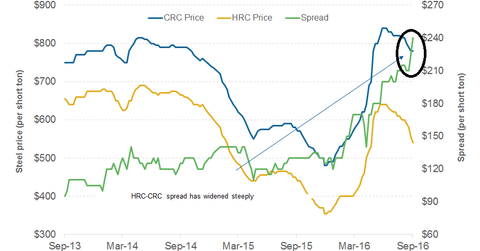

Previously, we looked at the recent movement in spot HRC (hot rolled coil) prices. Now, we’ll see how CRC (cold rolled) prices are shaping up this year and how it’s impacting the HRC-CRC spread.

Spread rises

The graph above shows the spread between spot HRC and CRC prices as estimated by the Metal Bulletin. In the last five years, the average spread between HRC and CRC prices has been ~$120 per short ton. Currently, the spread is at $240 per short ton, or double the historical average.

To be sure, the supply-demand equation for CRC is better than for HRC. CRC and corrosion-resistant steel products are used in consumer products such as automobiles and appliances. Both these sectors have been strong thanks to US consumer appetite. On the supply side, the lead times for CRC products are higher than for HRC products.

Would spread revert to mean?

During its 2Q16 call, AK Steel (AKS) pointed to a “significant rise” in CRC steel imports from Turkey, Vietnam, and Australia. AK Steel also said that “the gap between foreign and domestic prices has the potential to encourage increased import levels.” Notably, the issue of steel imports cropped up during the respective 2Q16 calls for U.S. Steel (X), Nucor (NUE), and ArcelorMittal (MT).

In our previous series, we noted that we could see a mean reversion in the HRC-CRC spread. However, let alone a reversion, the spread has continued to widen. Having said that, the rising spread between US and international steel prices could put pressure on US CRC prices in the near term.

It’s important to note that 2H16 has looked challenging for US steel companies (XME) for a while. You can read What Will Santa Bring for US Steel Producers This Christmas? to explore this more.

You can also visit Market Realist’s Steel page for more updates on this industry.