Difference Between Consumer Discretionary and Consumer Staples

GDP growth has explained 30% of returns in the consumer discretionary sector in the last ten years. This compares to only 20% for the consumer staples sector.

Sept. 19 2016, Updated 1:58 p.m. ET

Consumer Discretionary vs. Consumer Staples Sectors

The consumer discretionary sector is characterized by those businesses that tend to be the most sensitive to economic cycles, including hotels, restaurants, and other leisure facilities, media production and service, and consumer retailing and services in its services segment.

The consumer staples sector is made up of companies whose businesses are less sensitive to economic cycles, including manufacturers and distributors of food, beverages and tobacco and producers of non-durable household goods and personal products.

Market Realist – The difference between consumer discretionary and consumer staples

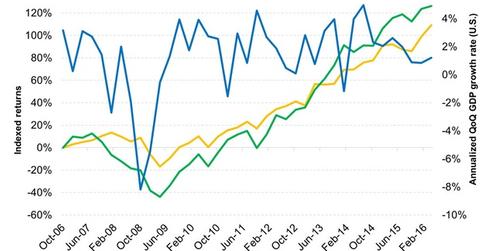

The above graph compares the performances of the consumer discretionary (XLY) and the consumer staples (XLP) sectors, along with GDP growth. Consumer staples tend to be stable, while discretionary stocks tend to be more volatile. During the crisis, staples fell by 17%, while discretionary fell by more than 40%.

As you can see in the graph, staples outperformed discretionary stocks during the financial crisis. However, as the economy improved, consumer discretionary started to outperform staples. Since the bull market began in March 2009, discretionary stocks have surged by a whopping 300%. In the same period, staples have risen by 150%, and the S&P 500 index (IVV) has risen by 176%.

GDP growth has explained ~30% of returns in the consumer discretionary sector in the last ten years. This compares to only 20% for the consumer staples sector.

The consumer staples sector includes companies that manufacture or sell products that are essential for living. Consumer discretionary stocks include companies that manufacture or sell products that aren’t essential for living and are dependent on the disposable income of households. Higher disposable income usually leads to more spending on discretionary items.

The investments of BITE place this ETF in consumer discretionary territory. BITE can provide investors with exposure to the marked increase in discretionary spending, which is observable in the current bull market.