AT&T Is Investing Heavily in This to Grow Its 4G LTE Footprint

AT&T already spent $10.3 billion in capex in the first half of 2016 and expects to spend a total of $21 billion in 2016.

Sept. 23 2016, Updated 8:06 a.m. ET

AT&T and Verizon spending large on capex

In the previous parts of this series, we discussed the network performances of Verizon Communications (VZ) and Sprint (S). Now we’ll take a closer look at AT&T (T), which has been investing heavily in capital expenditures, or capex, to improve its network and buy additional spectrum for future use.

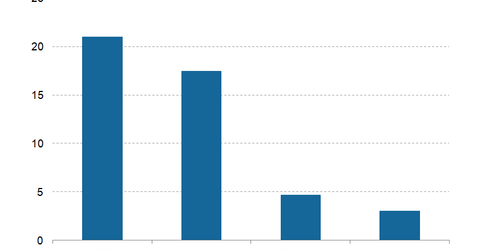

AT&T already spent $10.3 billion in capex in the first half of 2016 and expects to spend a total of $21 billion in 2016. By comparison, competitors Verizon (VZ), T-Mobile (TMUS), and Sprint (S) are expected to spend $17.5 billion, $4.7 billion, and $3.0 billion, respectively, on capex this year.

In the past, AT&T spent heavily on its Project Velocity IP, or VIP, a program aimed at upgrading its wireless and wireline broadband infrastructure. AT&T claims that its network now has 70,000 cell sites—much more than any competitor. The company has now expanded its LTE reach to Mexico, which means AT&T’s 4G LTE footprint now covers 380 million people in North America.

T-Mobile and Sprint have lower operating cash flow

AT&T has also spent on garnering more spectrum in the last few years. The company has 150 MHz of spectrum available to deploy, and it plans to shut down its lower margin 2G network gradually, which means it will have additional spectrum for deployment.

By comparison, both T-Mobile’s and Sprint’s lower spending on capex comes from their lower operating cash flows and the rising debt on their balance sheets. AT&T and Verizon generated $18.2 billion and $12.8 billion, respectively, in operating cash flow in the first half of 2016, which gave them leeway to direct more toward capex.

In the next part, we’ll discuss 5G technology.