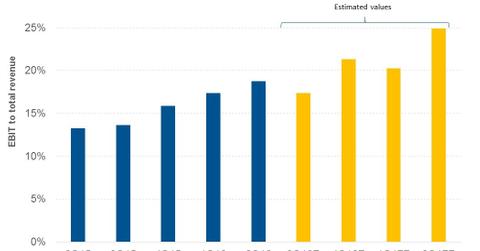

Why Did Wendy’s EBIT Margins Expand in 2Q16?

In 2Q16, Wendy’s posted EBIT of $71.7 million—an EBIT margin of 18.7% compared to 13.3% in 2Q15. Analysts expected the EBIT margin to be 16.7%.

Dec. 4 2020, Updated 10:42 a.m. ET

EBIT margin

In 2Q16, Wendy’s (WEN) posted EBIT (earnings before interest and tax) of $71.7 million—an EBIT margin of 18.7% compared to 13.3% in 2Q15. Analysts were expecting Wendy’s EBIT margin to be 16.7%.

EBIT margin drivers

Refranchising restaurants and deflation in commodity prices expanded Wendy’s EBIT margin in 2Q16. Sales leverage from positive same-store sales growth of 1.2% in company-owned restaurants also contributed to the EBIT margin’s expansion. An increase in revenue from franchisees increases the EBIT margins—franchised restaurants’ operating margins are higher.

Favorable commodity prices have brought the cost of sales down from 64% in 2Q15 to 52.9% in 2Q16. However, general and administrative expenses increased from 12.4% to 16% due to an increase in severance expenses. This was partially offset by employee compensations due to the optimization initiative.

Peer comparisons

During fiscal 2Q16. Wendy’s peers such as Jack in the Box (JACK) and Restaurants Brand International (QSR) posted EBIT margins of 15.1% and 41.3%—compared to 14.9% and 30.7% in 2Q15, respectively.

Outlook

Wendy’s management stated that the deflation for fiscal 2016 is expected to be 5%–6%. Also, with refranchising continuing in last two quarter of 2016, analysts are expecting the company to post EBIT margins of 18.6% in fiscal 2016—compared to 13.2% in fiscal 2015. In 1Q17 and 2Q17, analysts are expecting the EBIT margins to expand to 20.2% and 24.9%, respectively.

Next, we’ll look at Wendy’s earnings per share in 2Q16.