A Glance at Flowserve’s Primary Working Capital after 2Q16

In the current volatile global scenario, Flowserve’s (FLS) 2Q16 revenue and net profit have risen by 11% and 28%, respectively, year-over-year.

Aug. 8 2016, Updated 11:05 a.m. ET

What does Flowserve’s management say

In the current volatile global scenario, Flowserve’s (FLS) 2Q16 revenue and net profit have risen by 11% and 28%, respectively, year-over-year. The company is expected to maintain its adjusted operating margin in the range of 10.5%–12.5%.

FLS’s management hasn’t given any guidance on its operating margin going forward. However, the company’s management is confident that its operating margins will stay above 10.5% on the back of better productivity and cost control measures.

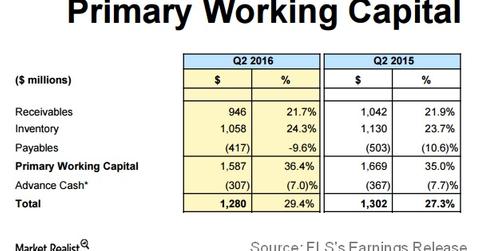

FLS is strategically reducing its working capital requirement as a percentage of sales. In 2Q16, its primary working capital as a percentage of sales was 36.4% compared to 35.0% in 2Q15. The company’s target for 2016 is below 35.0%. It was at 32.7% in 4Q15.

Factors such as revenue falls and marginal improvement in operating margins may enhance FLS’s working capital requirement in 2016. This will suppress the company’s free cash flow.

FLS generated adjusted free cash flow of -$95 million in 1H15 compared to -$33 million in 1H16. Free cash flow is important because it allows a company to pursue opportunities that enhance shareholder value.

As per analysts’ expectations, Flowserve will generate free cash flow of $211 million in 2016, a fall of 10.2% compared to 2015. Similarly, FLS’s industrial (XLI) peer Emcor Group’s (EME) free cash flow is expected to be $180 million in 2016, a fall of 21.8% compared to 2015.

In 2016, Pentair’s (PNR) and Graco’s (GGG) free cash flows are expected to rise by 26.7% and 30.6%, respectively, over 2015.

In next article, we’ll discuss the savings Flowserve realized through its realignment program in 2Q16.