A Brief Look at the Technologies Segment Sales in 2Q16

In 2Q16, Dentsply Sirona’s leading position in the Digital Sensor category and rebound in the Lab business drove its Technologies segment sales.

Aug. 10 2016, Updated 9:06 a.m. ET

Dentsply Sirona’s Technologies segment sales

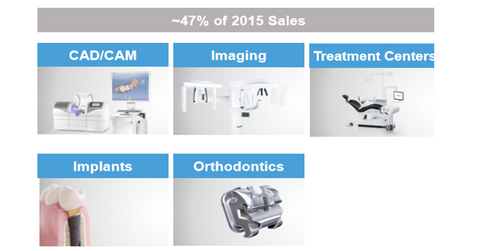

Dentsply Sirona (XRAY) reported ~$1.0 billion of revenues worldwide in 2Q16. Of that, ~$478.2 million was generated through Dentsply Sirona’s Technologies segment, which contributed ~47% to Dentsply Sirona’s total revenues.

On a constant currency basis, the Technologies segment’s sales grew by approximately 3.3%. The segment’s sales declined in Europe. The segment witnessed strong sales growth in 1Q16 and double-digit growth in 2015.

The Omni PLUS and BioForce PLUS brackets and wires under the Ortho Product category are some of the recent launches by the company in the Technologies segment. Dentsply Sirona acquired MIS Implants in June 2016 to complement the company’s Implant Brand business. It helped Dentsply Sirona enter the $1.5 billion value segment of the implant market.

For the acquisition details, please read Latest News on the Dentsply Sirona-MIS Acquisition.

Growth drivers

In 2Q16, Dentsply Sirona’s leading position in the Digital Sensor category and rebound in the Lab business drove its Technologies segment sales. Its Schick brand is a leading product of the company. The segment’s sales, however, were negatively affected by Intraoral Sensors’s lower shipments.

The Technologies segment’s Europe sales growth declined due to the tough comps last year, driven by a record International Dental Show (or IDS) and some key product launches.

Some of the major players in the US medical device industry include Abbott Laboratories (ABT), Zimmer Biomet Holdings (ZBH), and Boston Scientific (BSX), which reported 2Q16 YoY sales growth of 3.2%, 65.6%, and 15.4%, respectively.

Investors can invest in the iShares Russell Mid-Cap Value ETF (IWS), which has about a 0.44% exposure to Dentsply Sirona.