Inside the Fidelity Growth Company Fund Portfolio

FDGRX’s core sectors are information technology, consumer discretionary, and healthcare. The first two sectors make up a little over 60% of the portfolio.

Nov. 20 2020, Updated 4:36 p.m. ET

The Fidelity Growth Company Fund: overview

The Fidelity Growth Company Fund (FDGRX) “normally invests primarily in common stocks of domestic and foreign issuers that Fidelity Management & Research Company (FMR) believes offer the potential for above-average growth. Growth may be measured by factors such as earnings or revenue.”

The fund manager makes use of fundamental analysis, which includes factors like the financial condition and industry position of each issuer, and looks at economic and market conditions while selecting securities for the portfolio. Investors should note that this fund is closed to new investors.

The fund’s assets were invested across 389 holdings as of September 2016, and it was managing assets worth $37.8 billion as of the same date. As of the August portfolio, its equity holdings included NVIDIA (NVDA), Lululemon Athletica (LULU), Monster Beverage (MNST), Alnylam Pharmaceuticals (ALNY), and Skechers USA (SKX).

Portfolio changes in the Fidelity Growth Company Fund

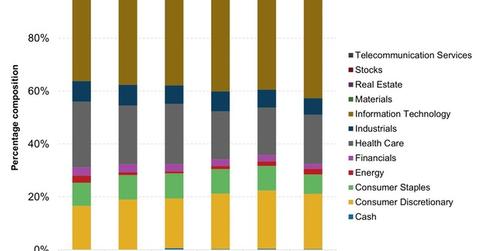

FDGRX’s core sectors include information technology, consumer discretionary, and healthcare. The first two sectors make up a little over 60% of the portfolio. The fund manager has not invested in the utilities sector.

FDGRX considers the Russell 3000 Growth Index as its benchmark index. Compared to this index, FDGRX is noticeably overweight the information technology and energy sectors but is sharply underweight in industrials, financials, materials, real estate, and telecom services.

A look at quarter-end portfolios for the past three years until September 2016 shows that not only has information technology remained the top invested sector throughout the period, but the fund’s exposure to stocks from the sector has risen. Among the consumer-focused sectors, discretionary has seen its share of the portfolio increase while staples has seen a near-constant fall. The healthcare sector has seen its share decrease as well.

But how has FDGRX performed so far in 2016, and what can the fund’s performance be attributed to? We’ll explore these questions in the next article.