Falling DRAM Prices Reduce Micron’s DRAM Margin

The overall DRAM market is slowing and despite this, Micron increased its exposure in this space from 54% in fiscal 2Q16 to 60% in fiscal 3Q16.

July 11 2016, Updated 11:06 a.m. ET

Operational changes in DRAM segment

In the previous part of the series, we saw that Intel’s (INTC) memory partner Micron Technology (MU) resorted to restructuring to improve margins as the falling DRAM (dynamic random access memory) prices pulled the company into losses.

The overall DRAM market is slowing and despite this, Micron increased its exposure in this space from 54% in fiscal 2Q16 to 60% in fiscal 3Q16. The exposure grew as the company transitioned more than 50% of its DRAM output on the 20nm (nanometer) node.

Financial performance

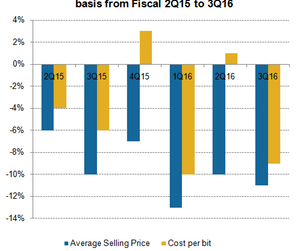

Although Micron’s DRAM sales grew by 22% quarter-over-quarter, its DRAM revenue grew by just 9% quarter-over-quarter in fiscal 3Q16 as its ASP (average selling price) fell faster than cost. The company’s transition to the 20nm node improved yields and reduced its cost per bit by 9% quarter-over-quarter in fiscal 3Q16.

However, its DRAM ASP fell by 11% quarter-over-quarter. This reduced the DRAM gross margin by ~2% to 18% in fiscal 3Q16.

The company earned in the high 20% range of its DRAM revenue from the Embedded segment and in the low 20% range from the Storage segment. It earned about 25% of its revenue each from its Computing and Mobile segments.

In the computing space, DRAM revenue was driven by an increase in demand from NVIDIA (NVDA) for GDDR5 and GDDR5X. The company’s DRAM finished goods inventory rose in fiscal 3Q16 due to the delay in design wins for the new 20nm DRAMs from mobile customers.

DRAM guidance

Micron expects its DRAM unit sales to grow further in fiscal 4Q16 as rivals Samsung (SSNLF) and SK Hynix reduce their DRAM output. Micron expects its DRAM bit to grow between 28% and 30% in fiscal 2016 and 2017.

On the supply side, Micron expects the DRAM industry supply to grow in the low- to mid-20% range in 2016 and in the mid- to high-teens in 2017—provided Samsung and SK Hynix do not increase their DRAM output.

Amid weakness in the DRAM industry, the company does not plan to add DRAM wafer capacity, but it plans to grow output by transitioning to 1X node in fiscal 2017. In the long term, the company expects bit demand to grow in the low- to mid-20% range.

Next, we will look at Micron’s NAND segment. The VanEck Vectors Semiconductor ETF (SMH) has holdings in 26 semiconductor stocks, including ~14.4% in INTC, ~4.6% in NVDA, and 3.7% in MU.