Energizer Holdings Acquired HandStands Holding for $340 Million

Energizer Holdings (ENR) has a market capitalization of $3.2 billion. It rose by 1.7% to close at $52.35 per share on July 1, 2016.

July 4 2016, Published 4:42 p.m. ET

Price movement

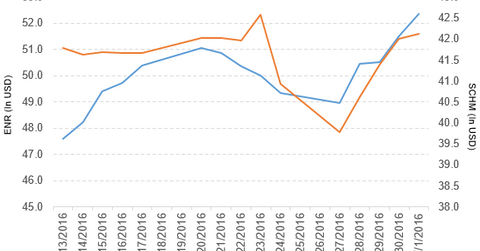

Energizer Holdings (ENR) has a market capitalization of $3.2 billion. It rose by 1.7% to close at $52.35 per share on July 1, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 6.1%, 9.8%, and 55.6%, respectively, on the same day.

ENR is trading 5.9% above its 20-day moving average, 13.0% above its 50-day moving average, and 31.2% above its 200-day moving average.

Related ETFs and peers

The Schwab US Mid-Cap ETF (SCHM) invests 0.32% of its holdings in Energizer. The ETF tracks a market cap-weighted index of midcap stocks in the Dow Jones US Total Stock Market Index. The YTD price movement of SCHM was 5.9% on July 1.

The SPDR S&P 400 Mid-Cap Value ETF (MDYV) invests 0.20% of its holdings in Energizer. The ETF tracks a market cap–weighted index of US stocks. The index uses three factors to select value stocks from the 400 stocks chosen by the S&P Committee.

The market capitalizations of Energizer Holdings’ competitors are as follows:

Energizer acquired HandStands Holding

Energizer Holdings has completed the acquisition of HandStands Holding Corporation from Trivest Partners. The purchase price for this transaction was $340 million in cash.

Performance in fiscal 2Q16

Energizer Holdings reported fiscal 2Q16 net sales of $334.0 million, a fall of 6.4% compared to net sales of $3.6 billion in fiscal 2Q15. Sales of its North America, Latin America, EMEA (Europe, the Middle East, and Africa), and Asia-Pacific segments fell by 0.47%, 22.8%, 3.7%, and 15.5%, respectively, in fiscal 2Q16, compared to the same period last year.

Energizer Holdings’ net income and EPS (earnings per share) rose to $16.4 million and $0.26, respectively, in fiscal 2Q16, compared to -$69.2 million and -$1.11, respectively, in fiscal 2Q15.

Energizer’s cash and cash equivalents rose by 14.8%. Its inventories fell by 21.0% in fiscal 2Q16, compared to fiscal 4Q15. Its current ratio rose to 2.6x in fiscal 2Q16, compared to 2.3x in fiscal 4Q15.

Projections

Energizer Holdings has made the following projections for fiscal 2016:

- net sales to fall in the low single digits

- organic net sales to rise in the low single digits

- negative impact of foreign currency movements on net sales of $60 million–$70 million

- international go-to-market changes to reduce net sales in the low single digits

- deconsolidation of Venezuela results to reduce net sales by $8.5 million

- gross margin rates to fall by 2.5% due to unfavorable currency impacts, international go-to-market changes, the impact of the Venezuela deconsolidation, and investments in product improvements and productivity initiatives

- an income tax rate of 29%–30%

- adjusted earnings before interest, tax, depreciation, and amortization of $280 million–$300 million

- free cash flow exceeding $150 million

- spin and restructuring costs of $15 million–$20 million

In the next part, we’ll take a look at Newell Brands.