Can Eastman’s Additives & Functional Products Segment Deliver?

Eastman Chemical’s (EMN) Additives & Functional Products segment is the company’s strongest segment. It has grown significantly since 1Q14.

July 12 2016, Updated 10:06 p.m. ET

Additives & Functional Products segment

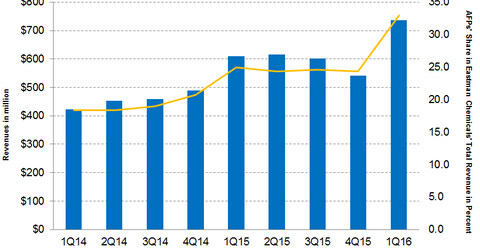

Eastman Chemical’s (EMN) Additives & Functional Products (or AFP) segment is the company’s strongest segment. It has grown significantly since 1Q14. In 1Q16 the segment recorded revenue of $737 million. Under the company’s new reporting structure that began in 1Q16, Adhesives & Plasticizers and Specialty Fluids and Intermediates were integrated into AFP.

When compared according to the newly aligned format, the segment declined 8.3% on a year-over-year basis. However, if you take it as a separate segment, it has shown growth since 1Q14 with the exception of 3Q15 and 4Q15.

The Additives & Functional Products segment’s contribution to EMN’s total revenue has been growing significantly. In 1Q14, the segment’s contribution was 18.4%. In 1Q16, it was ~33%, making it Eastman’s highest revenue-generating segment.

Management outlook

According to Eastman’s management, this segment is poised for good growth. The following factors could drive the segment’s growth:

- demand for quality vehicles

- improved demand in the housing market

- ever-growing demand of consumables from the growing middle class

- growth in tire resins and architectural paints business

- initiatives in product innovation

However, the segment does have challenges such as low selling prices, increased competition on certain products, and a negative currency impact due to the strengthening of the dollar.

As of July 1, 2016, the PowerShares DWA Basic Materials Momentum ETF (PYZ) held ~3.5% of its portfolio in Eastman Chemical. Some of the fund’s other top holdings include Ashland (ASH), PPG Industries (PPG), and Air Products & Chemicals (APD) with weights of 5%, 3.9%, and 3.4%, respectively.

In the next part, we’ll take a look at Eastman Chemical’s operating cash flow.