Can Celanese Outperform Analysts’ Revenue Estimates in 2Q16?

Celanese (CE) will announce its 2Q16 earnings report on July 26, 2016. In this series, we’ll look at the company’s 2016 guidance and valuations, analysts’ expectations, and other factors that could help investors make informed decisions.

July 14 2016, Published 3:56 p.m. ET

Celanese to declare 2Q16 earnings

Celanese (CE) will announce its 2Q16 earnings report on July 26, 2016. Its peers PPG Industries (PPG), Eastman Chemicals (EMN), and FMC Corporation (FMC) are scheduled to announce their 2Q16 earnings reports on July 21, July 28, and August 3, respectively.

In this series, we’ll look at the company’s 2016 guidance and valuations, analysts’ expectations, and other factors that could help investors make informed decisions.

Revenue estimates for Celanese

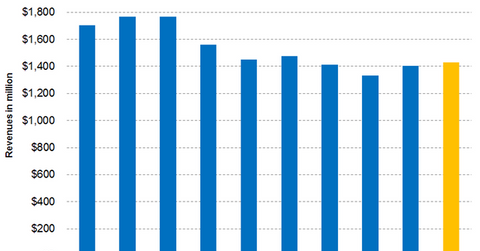

Analysts have estimated Celanese’s 2Q16 revenue to be ~$1.4 billion, implying a decrease of 3.3% on a year-over-year (or YoY) basis. On a sequential basis, this implies a 1.7% increase.

Management guidance

Celanese’s (CE) management expects the growth to continue in its Polymer portfolio and Acetyl Chain segment. In this regard, Celanese has increased the prices of its Ateva EVA and LDPE polymers twice during 2Q16. Ateva EVA is used in products such as document lamination, cheese packaging, and gift cards.

LDPE polymers have applications in the automotive and medical industries. These applications have also increased the prices of acetic acid in EMEA (Europe, Middle East, and Africa) and China.

The benefits of this price increase can be seen in Celanese’s 2Q16 earnings. On July 1, 2016, Celanese also increased the prices of several other products, and the company expects to see these benefits in 3Q16.

Geographically, Celanese expects modest growth in Europe and North America, but some sluggishness can be expected in Europe due to the Brexit vote. Celanese expects 8%–10% growth in its adjusted EPS (earnings per share) for 2016. However, the sluggish global economic environment could subdue Celanese’s growth.

On July 12, the PowerShares DWA Basic Materials Momentum Portfolio ETF (PYZ) held 3.1% of its portfolio in Celanese (CE).

In the next part, we’ll look into analysts’ recommendations for Celanese.