Where Is the US Food Retail Industry Headed? A Look at Trends

The US food retail industry comprises of store formats that range from small grocery shops and convenience stores to large supermarkets and club stores.

Feb. 16 2016, Updated 3:06 p.m. ET

The US food retail industry: A quick look

The US food retail industry comprises of store formats that range from small grocery shops and convenience stores to large supermarkets and club stores. The supermarket format represents the largest segment of the food retail industry.

According to Progressive Grocer’s 82nd Annual Report of the Grocery Industry, the US supermarket industry (which includes conventional supermarkets, supercenters, warehouse grocery stores, military commissaries, and limited-assortment, natural, and gourmet supermarkets) had approximately $638.3 billion in sales in 2014, an increase of 2.9% over the prior year. Let’s look at the main trends in the US food retail industry.

Market concentration on a rise

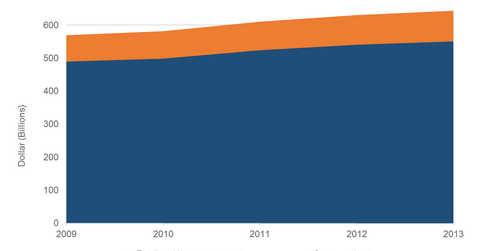

There has been an increase in market concentration in the US grocery industry on account of continuous consolidation. While the top four players accounted for 17% of the total industry sales in 1992, they accounted for more than 35% of total sales in 2013. The top four players in the US grocery industry in 2013 were Walmart (WMT), Kroger (KR), Safeway, and Publix Super Markets.

Competition becoming fierce

Competition is on the rise in the grocery segment as larger players such as Walmart (WMT) and Target (TGT), supermarkets such as Kroger (KR), and organic and specialty retailers such as Whole Foods Market (WFM), Sprouts Farmers Market (SFM), and The Fresh Market (TFM) are competing to woo customers with similar products.

Share of online sales increases

The online channel has been increasing its presence in the grocery sector. Online grocery sales as a percentage of total grocery sales in the United States stood at 4% in 2014. However, it is projected to go up to 11%–17% by 2023, according to Brick Meets Click data, as customers get comfortable with the idea of shopping online.

Share of natural and organic foods increases

Progressive Grocer’s 82nd Annual Report of the Grocery Industry cited that the natural food channel has been growing at more than twice the pace of the conventional channel. According to the Organic Trade Association, US sales of organic foods and nonfoods are estimated to have hit nearly $40 billion in 2014. Presently, more than 80% of US families buy organic products.

ETF exposure and a look at what’s next

Investors looking for exposure to food retail stocks can choose to invest in the SPDR S&P Retail ETF (XRT). The Fresh Market (TFM), Kroger (KR), Whole Foods Market (WFM), and Sprouts Farmers Market (SFM) have a combined weight of 4.1% in the ETF. We’ll look at The Fresh Market’s financial performance in the next section.