Dental and Healthcare Consumables Grew but Missed Expectations in 2Q17

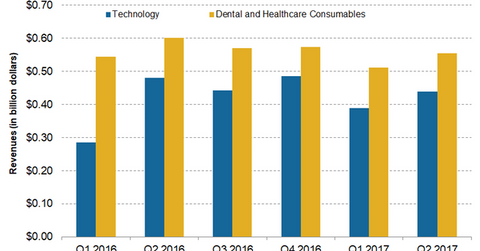

In 2Q17, Dentsply Sirona’s (XRAY) Dental and Healthcare Consumables business contributed ~56% to the company’s total revenues and registered sales of ~$554 million.

Aug. 16 2017, Updated 9:08 a.m. ET

Dental and Healthcare Consumables business performance

In 2Q17, Dentsply Sirona’s (XRAY) Dental and Healthcare Consumables business contributed ~56% to the company’s total revenues and registered sales of ~$554 million. The company’s Consumables segment consists of dental products that comprise restoratives, prosthetics, endodontics, instruments, and medical device consumables.

The reported segment sales represented YoY (year-over-year) sales growth of ~1.9%. The Dental and Healthcare Consumables business of Dentsply Sirona registered internal growth of ~2% in the quarter. The constant currency segment sales growth came in at ~3%.

Although the business reported growth in all regions, it failed to meet the company’s growth expectations. Notably, the Dental and Healthcare Consumables business also registered growth but failed to meet the company’s expectations in 1Q17 as well.

Segment growth drivers

XRAY’s US Consumables sales witnessed moderate growth in 2Q17. Some of the factors that impacted the segment’s sales include currency headwinds. Also, the company saw challenges from some integration efforts that are not fully complete and result in certain execution challenges.

Increased investment in R&D (research and development) impacts the company’s short-term earnings but could result in growth acceleration starting in fiscal 2018. However, the company plans to improve its performance in 2H17.

Peers Integra LifeSciences Holdings (IART), Zimmer Biomet Holdings (ZBH), and Align Technology (ALGN) registered YoY sales growth of 9.2%, 3.8%, and 30.0%, respectively, in their recently ended quarters.

Investors considering gaining exposure to Dentsply Sirona can invest in the Vanguard Mid-Cap ETF (VO), which holds ~0.37% of its total holdings in XRAY.

Next, we’ll look into the performance of Dentsply Sirona’s Technologies business in 2Q17.