Salesforce’s Subscription and Support Segment: Revenue Breakdown

Salesforce’s subscription and support revenue totaled $1.8 billion in 1Q17.

May 20 2016, Published 4:20 p.m. ET

Salesforce’s subscription and support revenue grows by 26%

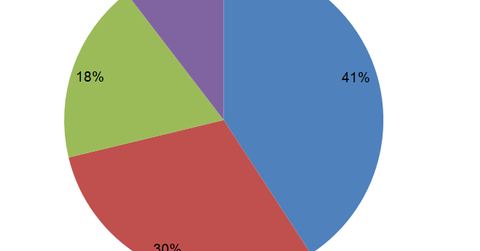

Previously in this series, we discussed Salesforce’s (CRM) fiscal 1Q17 earnings. Not one to disappoint the market and investors, Salesforce exceeded analysts’ expectations. We already know that Salesforce generates the majority of its revenues from the subscription and support segment. Salesforce’s subscription and support revenue totaled $1.8 billion in 1Q17. Let’s take a look at the offerings that contributed the most towards the 26% YoY (year-over-year) growth in subscription and support revenues.

Subscription and support: Revenue breakdown

Sales Cloud, the top contributor, earned 41% of Salesforce’s subscription and support revenue in fiscal 1Q17. Salesforce describes Sales Cloud as an offering that enables companies to store data about, monitor the progress of, gain insights into, and predict opportunities of any sale. It grew by 14.9% to $724.6 million.

Service Cloud enables companies to deliver customized customer service and support. It grew by 32% to $540.1 million. App Cloud, as an offshoot of the company’s Salesforce 1 platform, includes Heroku, Force.com functionality, and Lightning. App Cloud enables companies and developers to create apps. It grew by 45.5% to $325.9 million. Among Salesforce’s cloud offerings, App Cloud grew the most in fiscal 1Q17.

Salesforce’s Marketing Cloud grew by 29% to $184.9 million in fiscal 1Q17. Though Adobe (ADBE) leads the marketing cloud space, competition has increased in this space due to huge growth expected in the marketing cloud space. Apart from Salesforce, Oracle (ORCL) and IBM (IBM) are active in this space. Oracle, which announced the acquisition of AddThis in 2016, is aiming to strengthen its position in the marketing cloud space.

Read Key Players’ Offerings in the Marketing Cloud Space for more information. Investors who wish to gain exposure to Salesforce could consider investing in the iShares Core S&P 500 ETF (IVV). IVV has an exposure of ~8.4% to application software and invests 0.27% of its holdings in Salesforce.