Outlook for Comcast Cable’s High-Speed Internet and Business Services

In May 2017, Comcast introduced its new Wi-Fi gateway, xFi, which offers a personalized Wi-Fi experience to its users.

July 19 2017, Updated 9:10 a.m. ET

Comcast’s High-Speed Internet business

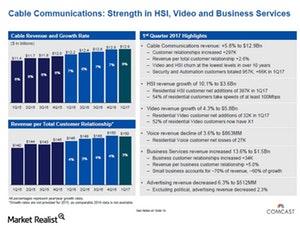

Comcast (CMCSA) is optimistic about the growth of its High-Speed Internet business, as it is continually innovating in this business. In May 2017, Comcast introduced its new Wi-Fi gateway, xFi, which offers a personalized Wi-Fi experience to its users. With products like xFI, the company is focusing on providing a better home Wi-Fi experience for its users.

Comcast also intends to implement market segmentation for its High-Speed Internet business and intends to provide various levels of services and speeds. The company’s High-Speed Internet business is the biggest generator of revenues for Comcast Cable. At the end of fiscal 1Q17, the company had additions of 429,000 High-Speed Internet customers.

Comcast’s Business Services segment

Comcast’s Business Services segment is a rising star for the company, and Comcast expects double-digit growth for this business over the next couple of years. Comcast’s Business Services serves small businesses, mid-sized businesses, and enterprises.

The company expects that the enterprise services market could be worth $13 billion–$15 billion. It expects this market to increase its market share in the small and mid-sized businesses.

Comcast’s Home Security business

Comcast is also bullish about its Home Security business, Xfinity Home, which is part of Comcast’s Other revenues. Xfinity Home was launched about six years ago. Currently, Xfinity Home has around 1 million customers. Comcast believes that the home security market could reach ~$9 billion in the United States (SPY) across the company’s footprint.