United Parcel Service: Fostering Business through Acquisitions

In 1988, United Parcel Service (UPS) bought its Italian partner, Alimondo, a move aimed at expansion in Europe. In the same year, UPS went on an acquisition spree.

April 6 2016, Published 5:38 p.m. ET

UPS’s acquisition spree

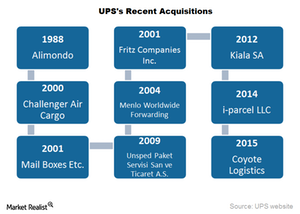

In 1988, United Parcel Service (UPS) bought its Italian partner, Alimondo, a move aimed at expansion in Europe. In the same year, UPS went on an acquisition spree. The company bought nine small-scale European parcel delivery firms to expand its own air service.

Post-IPO acquisitions

UPS’s 1999 public offering fetched ~$5.0 billion, which allowed UPS to strike big deals in the mergers and acquisitions space. Immediately after its public offering, UPS went on to acquire Challenge Air Cargo in 2000. Challenge Air Cargo was a Miami-based cargo company operating in Latin America. In the same year, UPS obtained the rights to fly directly to China from the US.

In 2001, the company acquired Mail Boxes Etc. in cash for ~$185.0 million. Mail Boxes Etc. operated a global chain of 4,300 franchised shipping and mail services stores. In May 2001, UPS’s ambitions to be the biggest global supply-chain management company led to the $456 million acquisition of Fritz Companies, which specialized in logistics, customs brokering, and freight forwarding. Fritz Companies was renamed UPS Freight Services. This acquisition broadened United Parcel’s offerings to small and home-based businesses and consumers.

One year later, UPS Freight Services merged with UPS Logistics Group, giving rise to UPS Supply Chain Solutions. The new entity operates in 120 countries and provides logistics and distribution, freight forwarding, and international trade management services.

In 2012, UPS acquired Kiala SA. Kiala is a Belgium-based developer of a platform that enables e-commerce retailers to provide their shoppers with the delivery option of a preferred retail location. Kiala operates in Belgium, France, Luxembourg, the Netherlands, and Spain. The acquisition broadened UPS’s service portfolio for business-to-consumer deliveries.

Most recent acquisitions

In 2014, UPS acquired i-parcel LLC, a US-based international e-commerce enabler and logistics company operating in the US and the UK. In the next year, UPS agreed to acquire Coyote Logistics, a non-asset-based truckload freight brokerage company for $1.8 billion from Warburg Pincus. Again in 2015, United Parcel acquired the Insured Parcel Services division of G4S International Logistics. This acquisition was targeted to add customers looking for high-value jewelry, watches, and collectibles shipments.

Surprisingly, UPS, along with the major western US railroad Union Pacific (UNP), opposed Canadian Pacific’s (CP) proposed takeover of Norfolk Southern (NSC) in late 2015. The Industrial Select Sector SPDR ETF (XLI) invests 7.3% of its portfolio in major US Class I railroads.