American Tower: A Peer Comparison

AMT’s current price-to-FFO ratio stands at 20.06x. The company has undertaken several acquisitions and strategic partnerships to boost its presence in high-demand geographies.

July 21 2017, Updated 7:39 a.m. ET

Price-to-FFO

The price-to-FFO (funds from operations) ratio is used for evaluating real estate investment trusts (or REIT). It carries the same meaning as the PE (price-to-earnings) ratio, which is used for measuring the relative valuations of companies in other industries.

Peer group price-to-FFO

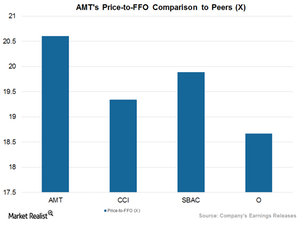

AMT’s current price-to-FFO ratio stands at 20.06x. The company has undertaken several acquisitions and strategic partnerships to boost its presence in high-demand geographies, and it’s elevated its guidance for its FFO and revenue for 2017. These moves have likely triggered the spike in its stock price, pushing its price-to-FFO ratio higher.

Considering AMT’s price-to-FFO ratio, its stock is trading in line with those of its peers. Crown Castle International (CCI), Realty Income Corporation (O), and SBA Communications (SBAC) are trading at price-to-FFO ratios of 19.34x, 18.67x, and 19.89x, respectively.

Peers’ dividend yields

Currently, American Tower offers a next-12-month dividend yield of 1.9%, which is in line with the yields of its close competitors. Crown Castle has a dividend yield of 3.9%, Realty Income has a dividend yield of 4.5%, and Simon Property Group has a dividend yield of 4.8%.

Net asset value also determines the value of an REIT. The ProShares Ultra Real Estate ETF (URE) holds almost 17% in AMT and its peers. The ETF is diverse in terms of both geography and products, so it offers a cushion to investors. URE has a net asset value of $62.92 per share.

AMT has a net asset value growth rate of 2.6%, CCI has a net asset value growth rate of -5.3%, and SBAC has a net asset value growth rate of -0.5% for the next 12 months.