Samsung’s Market Share Is Expected to Increase in Fiscal 2016

Samsung’s market share for the quarter was 45.2%, a gain of 1.1 percentage point YoY compared to 2Q14. It was Samsung’s best ever quarterly performance.

Dec. 10 2015, Updated 8:07 a.m. ET

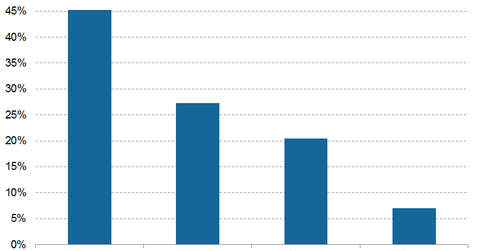

Samsung’s market share increased 1.1 percentage point in 2Q15

Samsung (SSNLF) continued its streak of dominating the DRAM (dynamic random access memory) market in 2Q15, according to IHS. As we saw in Part 2 of this series, the DRAM market is dominated by three players: Samsung (SSNLF), SK Hynix (HXSCF), and Micron Technology (MU). In the data released by HIS for 2Q15, Samsung’s market share for the quarter was 45.2%, a gain of 1.1 percentage point YoY (year-over-year) compared to 2Q14. It was Samsung’s best ever quarterly performance. The company is expected to increase its DRAM market share in 2016.

Analysts expect major players to cut investments in chips

Samsung might benefit in 2016. Analysts expect major players to cut their investments in chips, as prices in the DRAM market are likely to fall, driven by a weak demand in digital devices.

At the end of 2Q15, SK Hynix was the second largest player in the DRAM segment with a market share of 27.3%. It was followed by Micron Technology (MU) with 20.4% market share.

To get exposure to Micron Technology, you can invest in the iShares PHLX Semiconductor ETF (SOXX) and the VanEck Vectors Semiconductor ETF (SMH). Micron Technology constitutes 3.6% of SOXX and 3.4% of SMH.

Revenue growth of Global DRAM Industry fell 4.8% in 2Q15 as prices continued to drop

According to DRAMeXchange, the global DRAM industry’s revenue for 2Q15 was $11.4 billion, a decline of 4.8% YoY (year-over-year) compared to 2Q14. The revenues declined due to a fall in prices. However, operating margins for major players such as Samsung, SK Hynix, and Micron Technology were healthy at 48%, 37%, and 21%, respectively.

Avril Wu, DRAMeXchange’s assistant vice president, said, “In terms of global DRAM market share based on revenue, Samsung and SK Hynix respectively took 45.1% and 27.7% in the second quarter. Together, the top two suppliers accounted for over 70%.”

Micron Technology’s market share fell about 20.6% in 2Q15 due to lower prices and a lack of bit supply growth.