Does Praxair Have a Sustainable Debt Maturity Profile?

Praxair’s total debt has increased significantly, rising from $6.6 billion in 2011 to $9.3 billion in 2014.

Jan. 5 2016, Updated 10:05 a.m. ET

Debt profile

Praxair’s total debt has increased significantly, rising from $6.6 billion in 2011 to $9.3 billion in 2014. This has been due to the consistent increase in its long-term debt. Its long-term debt increased from $6.2 billion in 2011 to $8.7 billion in 2014. Its short-term debt also increased, from $337 million in 2011 to $587 million in 2014. The company has consistently raised debt to fund its capacity expansion plans and acquisitions. Praxair has raised long-term debt with different interest rates, ranging from 0.75% to 5.4%, with the different maturities. The company has primarily raised debt from the US market. Praxair’s short-term borrowings have a weighted average interest rate of 0.6% as of December 2014. Apart from this, the company had $2.5 billion of senior unsecured undrawn credit facility at the end of 2014.

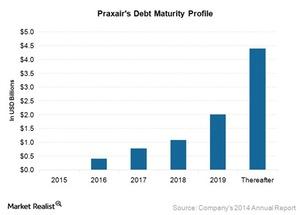

Debt maturity

Though Praxair has relatively higher debt, it is largely long-term maturity debt. The company has only $2 million of debt maturing in 2015 and $407 million of debt maturing in 2016. The company generated more than $1 billion of free cash flow in 2014, which is sufficient to repay the debt. The company has debt maturities of $775 million in 2017, $1,083 million in 2018, $2,008 million in 2019, and $4,396 million after 2019. The company has $2 billion of debt maturity in 2019, which is higher than its current free cash flow. If the free cash flow remains at the same level, Praxair may reduce its dividend and share buybacks in 2019 to pay its debt.

Praxair’s closest peers Airgas (ARG) and Air Products and Chemicals (APD) had total debts of around $2 billion and $6 billion, respectively, in 2014. Airgas and Air Products and Chemicals also have mainly long-term maturity debt. Air Products and Chemicals has a long-term debt of $4.9 billion, with $2.7 billion of debt maturity beyond 2019.

The Materials Select Sector SPDR ETF (XLB) tracks the performance of chemical players. Earlier, it was known as the Basic Industries Select Sector SPDR ETF. The Dow Chemical Company (DOW) forms 11% of XLB’s total holdings.