Porter’s Five Forces Analysis for SUPERVALU

The Porter’s Five Forces model is extensively used for assessing the nature of competition and attractiveness in an industry.

Nov. 20 2020, Updated 11:45 a.m. ET

Porter’s Five Forces model

In this article, we’ll apply the Porter’s Five Forces model to SUPERVALU (SVU). The model is extensively used for assessing the nature of competition and attractiveness in an industry.

High competition within an industry divides the profit pie among a larger number of participants and reduces the share of each player. Industries with undifferentiated products and low barriers to entry face intense competition and have lower profits.

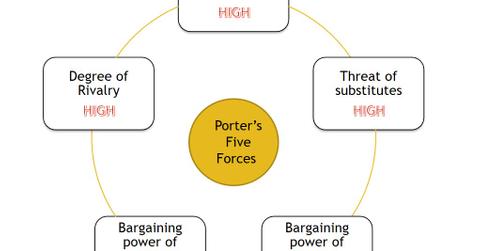

The Porter’s Five Forces model suggests that there are five forces that determine the attractiveness of an industry. These are as follows:

- Degree of rivalry within the industry

- Threat of substitutes

- Threat of new entrants

- Bargaining power of buyers

- Bargaining power of suppliers

Degree of rivalry within the industry

SUPERVALU faces intense competition from mainstream supermarket chains such as Kroger (KR), mass merchandisers such as Costco (COST) and Wal-Mart (WMT), and hard discounters such as Dollar General.

Bargaining power of buyers

SUPERVALU’s customers are free to purchase products from the company’s competitors without incurring any additional costs. In fact, the company has been struggling to maintain its same-store sales and margins because of high competition.

Bargaining power of suppliers

SUPERVALU sources its products from a large number of suppliers, both domestic and foreign, and should, therefore, have sufficient bargaining power with them. Though the sale of its banners in 2013 has weakened the company’s negotiating position with its vendors to some extent, the impact should not be substantial.

Threat of substitutes

SUPERVALU does not produce any differentiated products, and there are ample substitutes available from its competitors.

Threat of new entrants

There are not many barriers to entry in the grocery segment, as it does not require huge capital or expertise of operation. Even small retailers can compete within this industry.

ETF exposure

Due to its industry type, SUPERVALU is included in the portfolio holdings of the SPDR S&P Retail ETF (XRT) with a weight of approximately 0.9%.

For more updates and analysis, please visit Market Realist’s Supermarkets page.