Gold Touched Its Lowest Levels in the Last Six Years on Wednesday

Gold futures trading on COMEX, the commodity division of the New York Mercantile Exchange, fell 0.91% on December 2, 2015. Also, platinum fell 0.36%.

Dec. 3 2015, Published 9:37 a.m. ET

Precious metals plummet

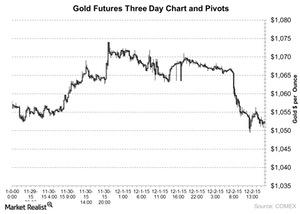

Gold futures trading on COMEX, the commodity division of the New York Mercantile Exchange, fell 0.91% on Wednesday, December 2, 2015. Gold touched fresh lows, extending further under the low seen in November. Gold slipped below $1,050 an ounce, and the day’s low of $1,049.4 an ounce. This is the lowest level gold has touched in the last six years. Other precious metals including silver, platinum, and palladium also plummeted. Silver lost 0.53% and closed at $ 14 an ounce. Also, platinum lost 0.36%. Finally, palladium was the worst-performing precious metal, as it fell 2.5% on Wednesday.

DXY Currency basket

The US dollar, depicted by the DXY Currency, is used to price the dollar against the six major world currencies. The US dollar has gained a whopping 13.5% over the past year. The DXY currency basket last closed at $100 on Wednesday, December 2.

The rise of the dollar is not favouring the assets that are dollar-denominated. Thus, most commodities are retreating, including precious metals.

Mining sector

The mining sector has seen enough carnage in the last one year owing to the sliding prices of metals. Mining stocks like Eldorado Gold (EGO), Cia De Minas Buenaventura (BVN), and Yamana Gold (AUY) have lost a significant chunk of their stock prices, close to 50%. Also, their current prices are trading at a discount to their 100-day moving average prices. These three stocks together determine 11.5% of the price changes in the VanEck Vectors Gold Miners ETF (GDX).

The mining-based ETFs Sprott Gold Miners (SGDM) and the SPDR S&P Metals and Mining ETF (XME) fell 25.2% and 48%, respectively, on a year-to-date basis.