How Is DuPont’s Geographical Sales Exposure and Global Presence?

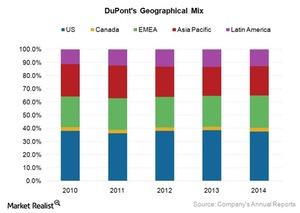

DuPont is a global company with operations in more than 90 countries. In 2014, the company’s North America region contributed 41% to its total revenue.

Dec. 14 2015, Updated 8:06 a.m. ET

Geographical sales exposure

DuPont (DD) is a global company, with operations in more than 90 countries. In 2014, the company’s North America region (United States and Canada) contributed 41% to its total revenue.

Europe, the Middle East, and Africa (or EMEA), the Asia-Pacific region (or APAC), and Latin America were other key geographies, with 2014 revenue contributions of 24%, 22%, and 13%, respectively.

Since DuPont generates 62% of its revenues from its international customers, the company’s earnings are sensitive to currency risks. Unfavorable currency fluctuations negatively impacted DD’s sales by 1% in 2014.

DuPont has exposure to forward currency contracts to minimize the losses arising from currency fluctuations.

DuPont’s manufacturing locations

DuPont has 322 manufacturing plants in 90 countries worldwide. These manufacturing plants are principally located in the United States, Canada, APAC, EMEA, and Latin America. The location details of DuPont’s facilities are as follows:

- Asia-Pacific – 71 manufacturing plants

- North America – 153 manufacturing plants

- Europe, the Middle East, and Africa – 70 manufacturing plants

- Latin America – 28 manufacturing plants

The above-mentioned 322 manufacturing facilities are further segregated on the basis of the following product categories:

- Agriculture – 130 manufacturing plants

- Electronics & communications – 30 manufacturing plants

- Industrial biosciences – 16 manufacturing plants

- Nutrition & health – 46 manufacturing plants

- Performance chemicals – 40 manufacturing plants

- Performance materials – 42 manufacturing plants

- Safety & protection – 42 manufacturing plants

Geographic exposure comparison

In 2014, DuPont generated 62% of its revenues from international customers. Peers Dow Chemical Company (DOW), LyondellBasell (LYB), and Monsanto Company (MON) have international exposures of 60%, 52%, and 54%, respectively.

Since both DD and DOW have higher international exposures than LYB and MON, their earnings are more sensitive to currency fluctuations and market volatility risks.

The Materials Select Sector SPDR ETF (XLB) tracks the performances of US-based basic material companies, including chemical players. DuPont forms 11.7% of XLB.