TJX Companies’ HomeGoods Segment Impressed in Fiscal 3Q16

TJX Companies’ HomeGoods segment reported strong same-store sales growth of 6%. The segment’s net sales grew by 12.8% to $959.8 million in 3Q16.

Nov. 20 2020, Updated 1:13 p.m. ET

US segments

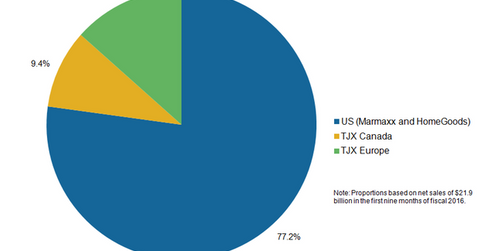

TJX Companies (TJX) conducts its business in the US through the Marmaxx and HomeGoods segments. The Marmaxx segment includes stores operated under the T.J. Maxx and Marshalls brands as well as tjmaxx.com. The Marmaxx and HomeGoods segments together accounted for 77.2% of the company’s net sales in the first nine months of fiscal 2016 ended October 31, 2015.

Marmaxx in 3Q16

In fiscal 3Q16 ended October 31, 2015, the Marmaxx segment’s net sales increased by 5.4% to $4.9 billion and same-store sales increased by 3%, driven by higher consumer traffic. Apparel, accessories, and home merchandise categories performed well in the quarter.

In the 3Q16 conference call, Carol Meyrowitz, TJX Companies’ president and chief executive officer, stated that this was the fourth consecutive quarter in which the merchandise margin increased. The company’s strategy to adjust its pricing and merchandise mix in order to offer bargain deals to shoppers helped increase traffic, units sold, and merchandise margins.

However, the segment profit margin of Marmaxx declined by 70 basis points due to higher wages and supply chain costs. As of the end of fiscal 3Q16, the company operated 1,149 T.J. Maxx stores and 1,001 Marshalls stores in the US.

HomeGoods segment impresses in 3Q16

TJX Companies’ HomeGoods segment reported strong same-store sales growth of 6%. The segment’s net sales grew by 12.8% to $959.8 million in 3Q16. The segment, which offers a differentiated collection of home fashions from around the world, witnessed a 10 basis point rise in profit margin in 3Q16. TJX Companies operated 522 HomeGoods stores as at the end of 3Q16

The iShares Core S&P 500 ETF (IVV) has 0.3% exposure to TJX Companies.

TJX Companies’ US business competes with off-price retailers Ross Stores (ROST) and Burlington Stores (BURL) and with the Nordstrom Rack stores operated by upscale department store Nordstrom (JWN). The 3Q15 same-store sales of Nordstrom Rack stores fell by 2.2%. The competition in the US off-price space is likely to intensify with Macy’s (M) announcing its expansion plans for its off-price Macy’s Backstage stores in its third quarter conference call.