Gauging Whole Foods’ Positioning in the US Organic Food Industry

Organic products are no longer available solely at farmers’ markets and specialty stores but are now available at local and traditional grocery stores.

Nov. 22 2015, Updated 10:05 a.m. ET

US supermarket industry overview

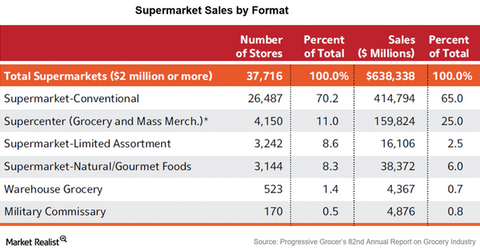

According to Progressive Grocer’s 82nd Annual Report on the grocery industry, the US supermarket industry, which includes conventional supermarkets, supercenters, warehouse grocery stores, military commissaries, and limited-assortment and natural or gourmet supermarkets, had approximately $638.3 billion in sales in 2014. This represents an increase of 2.9% over the previous year.

Whole Foods’ focus on organic

According to the same Progressive Grocer’s report, the natural food channel has been growing at more than twice the pace of the conventional channel. Organic products are no longer available solely at farmers’ markets or specialty stores but are now widely available at local and traditional grocery stores.

According to the OTA (Organic Trade Association), US sales of organic foods and non-food products are estimated to have hit nearly $40 billion in 2014—a new record. It is also estimated that as of 2014, more than 80% of US families are buying organic products. This higher demand has thus led to double-digit growth in organic sales of conventional grocery stores.

How is Whole Foods positioned?

Whole Foods Market (WFM) has long been synonymous with organic food in the US, having been the country’s leading organic grocery retailer while leading the nationwide movement toward organic and natural eating. However, with increasing competition from mainstream grocers, Whole Foods failed to maintain its number one position in the industry—a position that Costco Wholesale Corporation (COST) took over in 2015.

Traditional supermarket chains such as Kroger Company (KR) and mass merchandisers like Target Corporation (TGT) and Wal-Mart Stores (WMT) are offering customers natural and organic foods at competitive prices. According to a 2014 US Department of Agriculture study, three out of four conventional grocery stores were carrying organic goods as of 2014.

ETF exposures and what’s next

Due their industry type, Whole Foods (WFM) and Wal-Mart (WMT), Kroger (KR), and Costco (COST) are included in the portfolio holdings of the SPDR S&P Retail ETF (XRT). Together they account for approximately 4.1% of the total weight of the index.

Continue to the next part of this series for a discussion of Whole Foods’ approach to the online grocery shopping trend.