Fortinet Posts Record Billings and Revenue Growth in 3Q15

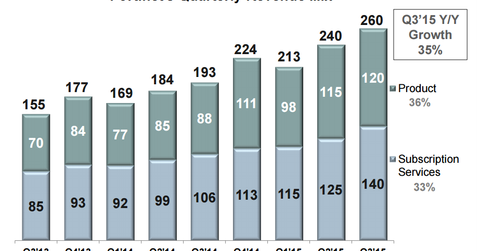

On October 22, 2015, Fortinet (FTNT) announced its 3Q15 earnings results. Its revenue of $260.7 million grew 34.5% YoY, the highest revenue growth rate in the past three years.

Oct. 27 2015, Published 11:08 a.m. ET

Fortinet posts highest revenue growth in three years

On October 22, 2015, Fortinet (FTNT), a provider of network security appliances and security subscription services, announced its 3Q15 earnings results. The company’s revenues and non-GAAP (generally accepted accounting principles) EPS (earnings per share) of $260.7 million and $0.14, respectively, marginally beat analyst expectations by $1.3 million and $0.02, respectively.

Fortinet’s revenue of $260.7 million grew 34.5% on a YoY (year-over-year) basis in 3Q15. That’s the highest revenue growth rate in the past three years.

Fortinet’s revenue growth due in part to Meru acquisition

Fortinet’s revenue growth in 3Q15 was partly aided by Fortinet’s acquisition of Meru Networks for $44 million, which closed on July 8, 2015. Meru Networks, a player in Wi-Fi networking, is engaged in the development and marketing of virtualized wireless LAN (local area network) solutions.

With the Meru acquisition, Fortinet expanded its solutions portfolio. It was also able to cater to the global enterprise Wi-Fi market with integrated and intelligent secure wireless solutions. Computerworld estimates this market to be worth $5 billion.

Commenting on the Meru acquisition, John Whittle, vice president of corporate development and general counsel for Fortinet, stated, “With this convergence between Wi-Fi and security, we have the security products, they have the wireless products, and we can bring those together.”

Currently, Cisco Systems (CSCO) leads the worldwide network security market. Check Point Software Technologies (CHKP), Symantec (SYMC), Huawei, Juniper Networks (JNPR), and Palo Alto Networks (PANW) are other leading players in this space.

Fortinet’s billings were the highest in 3Q15

In fiscal 3Q15, Fortinet’s billings stood at $299.6 million, an increase of more than 41% on a YoY basis. Since the company became public in late 2009, this is the highest billings it has ever recorded.

If you’re bullish about Fortinet’s prospects, you could invest in the PureFunds ISE Cyber Security ETF (HACK). HACK invests about 5.0% of its holdings in Fortinet.