Berkshire’s Insurance Segment Benefits From Fewer Claims

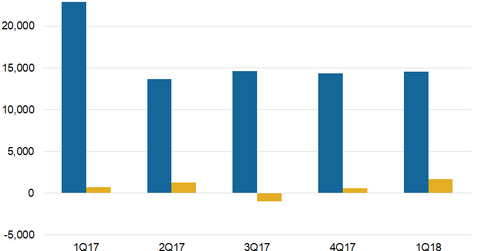

In 1Q18, Berkshire Hathaway’s (BRK.B) insurance revenue fell YoY (year-over-year) to $14.6 billion from $22.9 billion.

May 9 2018, Updated 5:20 p.m. ET

Insurance

In 1Q18, Berkshire Hathaway’s (BRK.B) insurance revenue fell YoY (year-over-year) to $14.6 billion from $22.9 billion, mainly due to Berkshire Hathaway Reinsurance Group revenue falling $9.7 billion as a result of scaling back amid operating losses. This fall was partially offset by growth in GEICO, Berkshire Hathaway Primary Group, and investment income.

The insurance sector (XLF) saw fewer claims in 1Q18, resulting in an improved loss ratio and underwriting profits. However, premium growth was subdued growth due to price hikes. Major insurance players Prudential (PRU), Chubb (CB), and AIG (AIG) also saw fewer claims in 1Q18.

Improved profitability

In 1Q18, Berkshire’s insurance operating profit rose YoY to $1.7 billion from $750 million due to lower reinsurance losses, GEICO, and higher investment income. Its margins were helped by higher pricing and organic policy growth.

The Fed is targeting at least two more rate hikes in 2018 amid higher macro growth and lower employment, which should improve insurers’ investment income through debt offerings or liquid funds. The sector is expected to see organic growth of 6%–9% in 2018 alongside various offerings’ better pricing. All areas except reinsurance, auto, property, casualty, and life are expected to see improved performance in 2018, subject to no major natural calamities as seen in 2H17.

Check out all the data we’ve added to our quote pages. Now you can get a valuation snapshot, earnings and revenue estimates, and historical data as well as dividend info. Take a look!