Rumors Strong about Sale of HP’s TippingPoint

HP is considering the sale of its TippingPoint business. Some private equity firms have shown interest in TippingPoint, valuing the business in the range of $200–$300 million.

Sept. 21 2015, Updated 3:06 p.m. ET

HP considering sale of TippingPoint

In the prior part of this series, we looked at Hewlett-Packard’s (HPQ) 3Q15 earnings results. In line with its planned breakup in November 2015, HP is currently reviewing all aspects of its business to pinpoint assets or divisions that may not fit the bill in either of the separate entities.

On September 2, 2015, Reuters reported that HP is considering the sale of its TippingPoint business. Some private equity firms have shown interest in TippingPoint, valuing the business in the range of $200–$300 million.

HP got hold of TippingPoint as part of its $2.7 billion acquisition of 3Com in 2010. TippingPoint’s specialty lies in intrusion prevention, threat detection, and network security management. It was part of HP’s Networking division until 2011. Now it functions within the company’s Software business.

Firewall market is extremely competitive

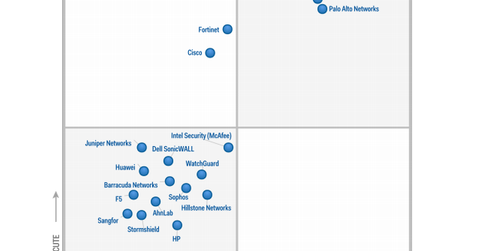

TippingPoint is essentially involved in hardware making for companies’ firewalls, which protect their networks. Although HP’s TippingPoint falls in the niche category, as the above Gartner’s Magic Quadrant shows, it operates in a crowded space with Barracuda (CUDA) and Intel’s McAfee (INTC), its peers and competitors. CheckPoint Software and Palo Alto Networks (PANW) emerged as leaders in Gartner’s Magic Quadrant for Enterprise Network Firewalls.

If you’re bullish about HP, you might consider investing in the Technology Select Sector SPDR (XLK), which invests about 1.25% of its holdings in HP.