What Investors Need to Know about Valuation Price Multiples

Valuation price multiples are used in the relative valuation technique. This is the most common method used by Wall Street to value stocks.

Nov. 20 2020, Updated 11:59 a.m. ET

Valuation price multiples

Any Wall Street analyst would tell you that valuation price multiples are very useful in their daily work. Regarding stocks, investment decisions are made using valuation price multiples. Valuation price multiples help investors understand how expensive or cheap a company’s stock is trading compared to its peers in the market. To understand valuation price multiples, we need to understand how the valuation is achieved.

Basics of stock valuation

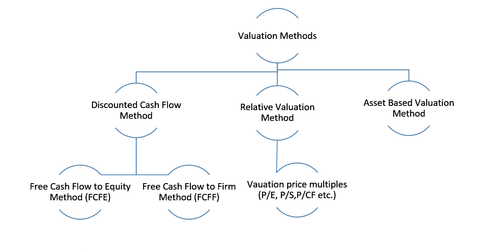

In simple terms, “stock valuation” means finding the intrinsic value of the equity portion of the company. Then, this is fragmented into the stocks that are issued. More than the intrinsic value, it’s the opinion value of the stocks. There are three ways that Wall Street determines the valuation of stocks.

- Absolute valuation—commonly known as “DCF” (discounted cash flow)

- Relative valuation

- Asset-based valuation

Valuation price multiples are used in the relative valuation technique. This is the most common method used by Wall Street to value stocks. The underlying principle behind this method is that in a strong and efficient market, comparable companies’ stocks should trade at similar prices.

Valuation price multiples are a base of this method where the average or median price multiples of the industry are used to find the intrinsic value of the particular stock. Wall Street analysts use different kinds of multiples for different industries depending on their business models. For example, different price multiples are used in retail. To learn more, read What Investors Need to Know about Valuing Retail Companies.

In this series, we’ll stay away from the normal practice of justifying the industry average or median multiples. Instead, we’ll analyze why some companies in the retail subsectors have huge spreads compared to the industry in terms of valuation multiples. Also, we’ll see if this is justified.

We’ll take the SPDR S&P Retail ETF (XRT) as a proxy for the retail sector in the US. XRT has exposure to 101 retail stocks in the US like Walmart (WMT), Amazon.com (AMZN), Macy’s (M), and Netflix (NFLX).