How the Rising Interest Rate Affects REITs like Weyerhaeuser

REITs (real estate investment trusts) depend on debt and equity for their working capital, and so they’re directly impacted by the Fed’s interest rate policy.

Sept. 12 2017, Updated 9:06 a.m. ET

Why the interest rate matters

REITs (real estate investment trusts) depend on debt and equity for their working capital. As a result, they are directly impacted by the Fed’s interest rate policy.

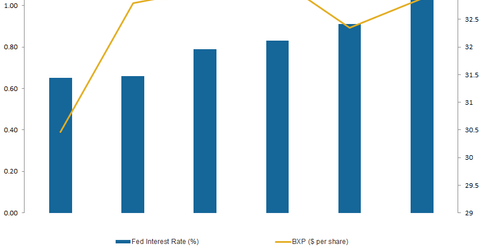

REITs have long thrived in the low-interest rate environment, but after a long period of record-low interest rates, the Fed has embarked on a policy to increase the interest rate gradually, targeting an interest level of 2%.

The Fed has hiked interest rate twice in 2017, and analysts expect another interest rate hike in 4Q17.

Notably, the growing US economy has positively impacted REITs like Weyerhaeuser, Rayonier (RYN), Resolute Forests Products (RFP), and International Paper (IP). WY, RYN, and IP make up ~20% of the iShares Global Timber & Forestry ETF (WOOD), which has 26 holdings in total, of which 23% are REITs.

Bonds more lucrative?

Since REITs mostly depend on debt, a higher interest rate increases the burden on debtors, as they have to face the brunt of higher rates when they borrow from the bank. Hence, some REITs could face a debt crunch in a high-rate environment.

When the interest rate increases, investors are sometimes drawn toward bonds, which provide more stability than equities. This is because, with high interest rates, the yields of REITs fall lower than those of bonds.

However, the long-term yields of REITs depend on the performance of the underlying assets of the particular REIT, and a rising interest rate is also accompanied by a growing economy.