U.S. Steel Recovers from 52-Week Low: But Is It out of the Woods?

U.S. Steel has bounced back from its 52-week low. In fact, most steel company earnings have been better than analyst expectations.

Aug. 5 2015, Updated 11:21 p.m. ET

U.S. Steel Corporation recovers from 52-week low

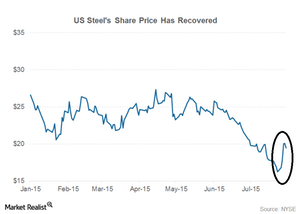

So far, 2015 has not treated steel stocks well. Most steel companies have hit 52-week lows in the last couple of months. In our previous monthly steel indicator series, we noted that steel industry indicators could be bottoming out. Yet, weak global macros continue to weigh heavily on steel company share prices.

2Q15 earnings

The 2Q15 earnings season for steel companies is nearly done. Companies including U.S. Steel Corporation (X), ArcelorMittal (MT), and Nucor (NUE) have already reported their 2Q15 financial results.

Nucor currently forms 5.23% of the SPDR S&P Metals and Mining ETF (XME) and 2.65% of the Materials Select Sector SPDR ETF (XLB).

Most steel company earnings have been better than analyst expectations. The market, it seems, was overly pessimistic about the US steel industry’s outlook.

Series overview

U.S. Steel has bounced back smartly from its 52-week low, as you can see in the above chart. In this series, we’ll analyze U.S. Steel’s 2Q15 earnings in detail. We’ll also discuss the guidance provided by U.S. Steel management about the second half of 2015.

U.S. Steel is running a transformation strategy called Carnegie Way. For more on this, read An insight into U.S. Steel’s transformation. With a disciplined approach, it’s working to strengthen its balance sheet with an intense focus on cash flow, improving operational efficiency, optimizing supply chain, and right-sizing its operations. U.S. Steel has had to make some hard decisions as part of this exercise.

In the coming parts of this series, we’ll analyze the benefits that U.S. Steel realized in 2Q15 under the Carnegie Way program. But before that, in the next part of the series, we’ll look at U.S. Steel’s consolidated 2Q15 earnings.