How Colgate Is Maintaining Margins in the Face of Headwinds

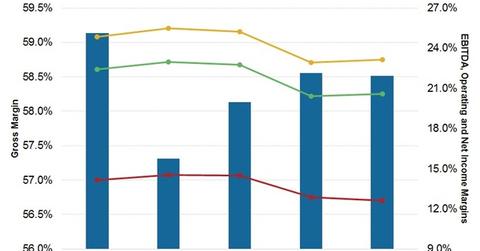

Colgate’s worldwide gross profit margin fell to 58.5% in 2014 from 58.6% in 2013.

Aug. 18 2020, Updated 5:20 a.m. ET

Gross profit margins and organic revenue growth

Colgate (CL) is a leading consumer staples (XLP) firm. Colgate’s worldwide gross profit margin fell to 58.5% in 2014 from 58.6% in 2013. This decrease was primarily due to raw material and packaging costs that were up 290 basis points, which included foreign exchange transaction costs.

Colgate achieved an organic non-GAAP[1. Non-GAAP is a measure that excludes the impact of acquisitions, divestitures and foreign exchange] revenue growth rate of 5% year-over-year in 2014. Procter & Gamble’s (PG) organic revenue growth rate came in at 2%, Unilever’s (UL) at 3%, and Kimberly-Clark’s (KMB) at 4% in 2014.

What kept margins from dropping severely?

Cost savings from Colgate’s “funding-the-growth initiative,” higher pricing, and cost savings from the 2012 restructuring program protected Colgate’s gross margin from a severe drop. The funding-the-growth initiative is designed to reduce costs associated with direct materials, indirect expenses, and distribution and logistics.

Also, the company implemented its 2012 restructuring program, a four-year initiative to help Colgate ensure continued solid worldwide growth in unit volume, organic sales, and earnings per share, as well as enhance its global leadership position in core businesses. This helped in raising the EBITDA (or earnings before interest, taxes, depreciation, and amortization) margin to 23.2% in 2014, compared to 22.9% in 2013.

Colgate’s operating margin increased to 20.6% in 2014 from 20.4% in 2013. Colgate follows a volume-driven growth strategy. This is evident by its organic revenue growth drivers. It’s organic revenue growth stood at 5% in 2014, of which volume expansion contributed 3%.

Volume-driven growth strategy

A volume-driven growth strategy typically results in relatively higher capital expenditure. Colgate estimates higher capital expenditure for 2015, as it aims at expansion in emerging markets and at raising volumes. Colgate’s capital expenditure for 2014 was $0.8 billion.

Colgate’s aim is to maintain balance between increasing prices and preserving volume growth. Colgate indicated that it will continue to raise prices in moderation in emerging markets to counter the unfavorable movement of foreign currencies and protect its margins.