Analyzing Colgate’s Competitive Position

As the consumer staples (XLP) sector is highly competitive, Colgate faces local as well as global competition from various local and international players worldwide.

July 27 2015, Published 11:06 a.m. ET

Competitive position

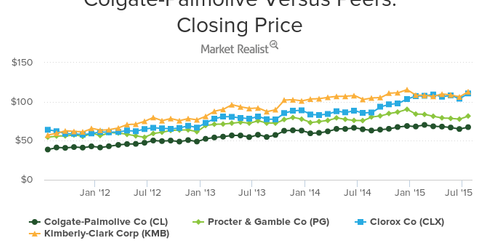

Colgate (CL) is a leading manufacturer and seller of household products. Colgate-Total, Colgate Max-Fresh, Softsoap, Sanex, Ajax, and Fabuloso are some of its famous brands. As the consumer staples (XLP) sector is highly competitive, Colgate faces local as well as global competition from various local and international players. The below chart shows Colgate’s stock performance versus its peers.

[marketrealist-chart id=541365]

Vertical forces: bargaining power of buyers and suppliers

The individual customer has very little influence on price or product because of low elasticity of products in the consumer staples sector. But if we consider Colgate’s retail (XRT) customers rather than individual customers, then Colgate and peers Clorox (CLX), Unilever (UL), and Kimberly-Clark (KMB) face strong bargaining power from their customers. Retailers like Wal-Mart (WMT) and Target (TGT) are able to negotiate favorable terms for pricing with these companies because they purchase and sell large quantities of their products.

According to a Reuter’s report published on June 24, WMT is seeking to charge a fee to all vendors for stocking and warehousing, thus raising supplier pressures. This could result in lower sales and profitability for Colgate and other suppliers.

Also, an increase in the prices of raw materials and commodities like resins, pulp, essential oils, tropical oils, poultry, corn, and soybeans, as well as packaging materials would adversely impact the financial results of Colgate.

Intensity of competition

Consumer packaged goods engulf a wide variety of products. As a result, Colgate faces stiff competition from several local and international players worldwide. For example, Colgate faces competition from Dabur Red toothpaste in India, which is a local brand.

Due to Colgate’s large product portfolio and its dominance in oral care, it’s very difficult for a new company to enter the market with a similar range of products. However, the relatively lower capital cost required for this business has given rise to a number of smaller local players worldwide.

Also, Colgate’s pricing power has been eroded with product substitution such as store brand products. The market share of private label products in Europe rose to 13.7% in 2014 from 11.5% in 2008, according to Kantar’s Global Footprint report.

Store brand products typically sell for less, compared to more recognized brands such as Colgate, Oral-B (PG), and Pepsodent (UL).