How MasterCard Generates Its Revenue

MasterCard’s revenue sources include transaction processing fees, as well as fees for fraud-prevention products and services.

June 25 2015, Updated 5:11 a.m. ET

Revenue sources

MasterCard’s (MA) primary source of revenue comes from the fees charged to issuing banks on the spending volume on cards and other products that it supports. Secondly, it charges fees for transaction processing and other related services. MasterCard’s pricing varies across the regions where it operates.

Revenues based on volume

MasterCard charges fees, called domestic assessments, from card-issuing banks, as well as acquiring institutions or banks. The domestic assessment is based primarily on the volume of activity on cards and other devices that MasterCard supports. As the name suggests, MasterCard charges domestic assessments in transactions where the merchant country and the issuer country are the same.

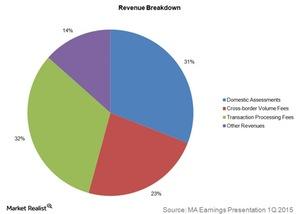

Domestic assessments account for 31% of MasterCard’s total revenues. The above graph gives a breakdown of MasterCard’s total revenues.

MasterCard also support transactions where the merchant operates in a different country from the card issuer. The revenues generated from these transactions are called cross-border volume fees, which contribute 23% to MasterCard’s total revenues.

Transaction-based revenues

MasterCard charges transaction processing fees, which vary depending on the number of transactions. These fees are charged on domestic and cross-border transactions, and they contribute 32% to MasterCard’s total revenues.

Other revenues include those generated from other payment-related products and services. It includes fees such as consulting and research fees generated by MasterCard’s advisory services. This revenue also includes fees for fraud-prevention products and services, which are implemented to prevent costly fraudulent transactions.

Rebates to promote products

MasterCard provides rebates and incentives to selected customers. These are deducted from the company’s gross revenues. Rebates and incentives are meant to encourage MasterCard clients such as card-issuing banks to promote MasterCard products. The rebates and incentives can be based on volume or other performance-related criteria such as the level of acceptance of MasterCard products.