Allianz Reports 11% Revenue Growth Backed by Insurance Business

Allianz Group offer property casualty insurance, life and health insurance, and asset management products and services in over 70 countries. The company’s major operations are in Europe.

Nov. 20 2020, Updated 2:56 p.m. ET

PIMCO casts a shadow over earnings

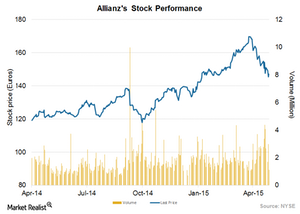

Allianz (AZSEY) reported its 1Q15 earnings on May 12. The company reported net income of 1.82 billion euros, up by 11% when compared with the first quarter of the previous year. Allianz also provided an outlook for 2015, projecting an operating profit of 10.4 billion euros plus or minus 400 million euros. The outlook for operating profit is similar to what the company achieved in 2014.

The company reported total revenues of 37.8 billion euros, up by 11% when compared with the previous year. The company’s growth was helped by property and casualty insurance. But this was partially offset by huge outflows of funds from PIMCO (Pacific Investment Management Company) upon the exit of Bill Gross.

In a company press release dated May 12, Allianz CFO (chief financial officer), Dieter Wemmer, said, “Allianz achieved very good results in the first quarter compared to last year’s already strong first quarter. While it is a promising start, the challenge of the current low-interest rate environment remains. However, we are well prepared for the rest of 2015.”

Insurance and asset management

Allianz Group offer property casualty insurance, life and health insurance, and asset management products and services in over 70 countries. The company’s major operations are in Europe.

In the insurance segment, it provides property-casualty and life and health insurance products to both retail and corporate customers. Its major premium-based markets are Germany, France, Italy, and the United States. It offers asset management products through PIMCO and AllianzGI (Allianz Global Investors), which have 1.8 trillion euros in assets under management. The major markets for its asset management business include the United States, Germany, France, Italy, the United Kingdom, and the Asia-Pacific region.

Here’s a look at the EPS (earnings per share) growth reported by its peers in the insurance and asset management business:

Together, these companies form 3.57% of the Financial Select Sector SPDR Fund (XLF).