Manulife Financial Corp

Latest Manulife Financial Corp News and Updates

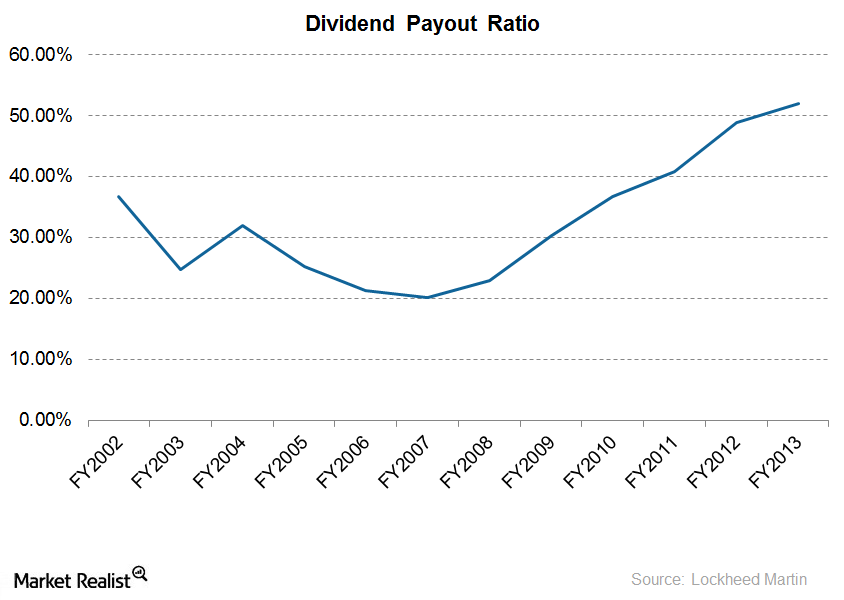

An investor’s introduction to Lockheed Martin Corporation

In 2013, Lockheed Martin clocked revenues of $45.4 billion. Of its revenues, 82% come from the U.S. government, around 17% from international customers, and 1% from other U.S. commercial customers.

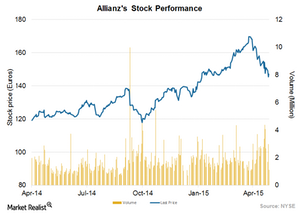

Allianz Reports 11% Revenue Growth Backed by Insurance Business

Allianz Group offer property casualty insurance, life and health insurance, and asset management products and services in over 70 countries. The company’s major operations are in Europe.