Davidson Kempner Initiates Stake in Apple

In February 2015, Apple announced its 1Q15 results and once again beat all analysts’ estimates.

Dec. 4 2020, Updated 10:51 a.m. ET

Davidson Kempner’s holdings in Apple

Davidson Kempner initiated a new position in Apple (AAPL) by purchasing 931,000 shares of the company, constituting 3.28% of the fund’s 4Q14 portfolio. Apple accounts for 17.95% of the Technology Select Sector SPDR Fund’s (XLK) portfolio.

Apple overview

Apple is based in Cupertino, California. The company designs, manufactures, and markets mobile communication and media devices, personal computers, and portable digital music players. The company also sells a variety of related software, services, peripherals, networking solutions, and third-party digital content and applications.

Apple’s products and services include the iPhone, iPad, Mac, iPod, Apple TV, iCloud, and the iOS and OS X operating systems. Apple also sells and delivers digital content and applications through the iTunes Store, App Store, iBooks Store, and Mac App Store.

Apple’s 2014 product launches

- In 1Q14, Apple introduced iPad Air, its fifth-generation iPad, and iPad mini with Retina display.

- At its Worldwide Developer Conference in June 2014, Apple announced iOS 8 and OS X Yosemite.

- In September 2014, Apple launched iPhone 6 and iPhone 6 Plus, and it released iOS 8. The company announced Apple Pay, which became available in the US in October 2014, and previewed Apple Watch, which is expected to be available in early 2015.

- In October 2014, Apple introduced iPad Air 2, iPad mini 3, iMac with Retina 5K Display, and an updated Mac mini. The company also released OS X Yosemite.

Icahn: Apple’s stock should traded higher

In October 2014, activist investor Carl Icahn said that Apple’s stock is dramatically undervalued. He believes that Apple’s stock should be trading at ~$203.

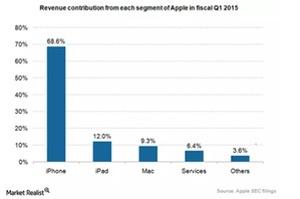

iPhone 6 drives Apple’s revenues

The main driver of Apple’s growth continues to be the iPhone. In December 2014, the success of the iPhone 6 and the iPhone Plus helped Apple beat Google’s (GOOG) Android-based smartphones in terms of market share in the US. According to a report from Kantar Worldpanel, Apple’s iOS market share of 47.7% narrowly edged out Android’s 47.6% share. The report also mentioned that Microsoft’s (MSFT) Windows with 3.8% market share and BlackBerry (BBRY) with 0.3% market share continue to struggle in this market.

Apple declares historic 1Q15 results that beat all estimates

In February 2015, Apple announced its 1Q15 results and once again beat all analysts’ estimates. The strong performance in the December quarter resulted in revenues of $74.6 billion. These results comfortably beat the company’s own midpoint estimates of $65 billion and analysts’ expectations of $67.3 billion. The increase in diluted earnings per share (or EPS) was even more dramatic. Apple’s diluted EPS of $3.06 per share was way above the analysts’ expectations of $2.58 per share.

We’ll look at Davidson Kempner’s new position in Kinder Morgan in the next part of this series.