Why Cisco’s Stock Increased by 10% in February

Cisco’s stock has gained 33% in the last year, while its main competitor in the switches and routers business, Juniper Networks, declined by 8%.

March 24 2015, Published 3:05 p.m. ET

Cisco’s stock has been on an upswing in the last year or so

In our previous series on Cisco (CSCO) titled Cisco: A Look at the Company’s Key Strengths and Weaknesses, we provided an overview of the company’s advantages and risks. We also discussed a possible reason for Cisco’s stock outperforming its peers over the last year or so. Cisco’s stock has gained 33% in the last year, while its main competitor in the switches and routers business, Juniper Networks (JNPR), declined by 8% during the same period.

In this series, we’ll discuss the most recent trends that are affecting Cisco. Cisco’s stock increased by 10% in February mainly because of its better-than-expected fiscal 2Q15 earnings, which it announced on February 11. Comparatively, the iShares S&P 500 Index ETF (IVV) managed to increase by 5% in February. IVV is an exchange-traded fund that tracks large-cap US equities.

Cisco’s better-than-expected earnings

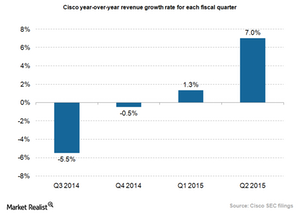

Cisco’s revenues of $11.9 billion beat consensus estimates of $11.7 billion, while its non-GAAP (generally accepted accounting principles) earnings per share of $0.53 per share were better than analysts’ estimates of $0.52 per share. As the chart above shows, Cisco’s year-over-year revenue growth rate continues to improve over time. Cisco’s GAAP earnings per share also included a pre-tax gain of $0.02 per share related to the reorganization of Cisco’s stake in VCE. This gain was excluded from non-GAAP earnings.

VCE is a joint venture among VMware (VMW), Cisco, and EMC (EMC). In an article titled Why the Relationship Between Cisco and EMC Is Strained, we discussed how, earlier, Cisco had a 35% equity interest in VCE. However, a few months back, EMC acquired more of a stake in VCE, increasing its holding from 58% to 83%. Cisco’s stake in VCE reduced from 35% to 10%.

To further please investors, Cisco announced an increase in its dividend payout to $0.21 per quarter, up from $0.19. Plus, Cisco also announced a better-than-expected outlook for fiscal 3Q15. The company now expects its revenues to increase by between 3% and 5% in the third quarter.