Walmart’s Capital Structure – A Mix Of Debt And Equity

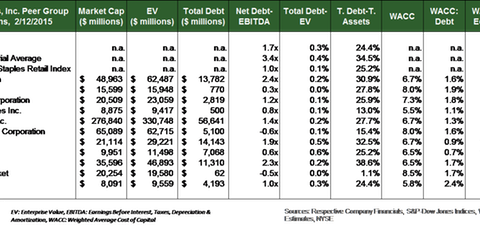

Walmart (WMT) has a mix of debt and equity in its capital structure. The retailer’s (XRT) total debt, both short and long-term, is ~$56.6 billion.

March 2 2015, Updated 6:05 p.m. ET

Leverage and ratings

Walmart (WMT) has a mix of debt and equity in its capital structure. The retailer’s (XRT) total debt, both short and long-term, is ~$56.6 billion. Its debt works out to 69.6% and 27.7% as a percentage of equity and total assets, respectively.

Credit ratings

Walmart is a blue-chip company. Its debt is rated investment-grade. This implies that ratings agencies believe there’s a high probability that the firm will meet its debt servicing commitments in a timely fashion.

The company’s long-term debt is rated AA by Standard & Poor’s, or S&P, and Fitch. It’s rated Aa2 by Moody’s. That’s two notches below the highest ratings awarded by these agencies. The company’s size, strong cash flow history, positive debt servicing history, and product and geographic diversification are some of the factors that determine the ratings.

Walmart’s free cash flow yield is at 4.9%. It’s higher than other retail companies. Costco (COST), Target (TGT), and Kroger (KR) have free cash flow yields of 3.3%, 3.4%, and 3.7%, respectively. Walmart’s yield is also higher than the industry average of 4.4%—as represented by the S&P 500 Food & Staples Retail Index.

Costco, Target, and Kroger also enjoy investment-grade ratings for their debt. However, they’re rated lower than Walmart.

- Kroger – Moody’s rating: Baa2, S&P rating: BBB

- Costco – Moody’s rating: A1, S&P rating: A+

- Target – Moody’s rating: A2, S&P rating: A

Kroger has the largest leverage ratios. Kroger’s leverage increased due to its $2.5 billion acquisition of premium supermarket chain, Harris Teeter, in 2014. The acquisition was financed with debt. As a result, Kroger’s debt ratings are lower.

Cost of capital

Credit ratings play an important role in determining a company’s debt commitments. The higher the credit ratings of a firm, the lower the cost of obtaining debt from capital markets. Walmart’s weighted average cost of capital, or WACC, is lower than the peer group average. That’s an advantage for the company when it takes recourse to capital markets.