Sprint’s liquidity must be maintained to fund capital investments

Sprint is cutting down on operating costs to manage high capital expenditures. But marginal cash flows aren’t alleviating Sprint’s liquidity concerns.

Dec. 4 2020, Updated 10:53 a.m. ET

High cost of network

In the last part of this series, we learned about Sprint’s (S) network expansion in the high-capacity 2.5 GHz (or gigahertz) frequencies. At these high frequencies, telecom companies incur higher costs than those in low-frequency networks.

In the United States, the other national carriers, including AT&T (T) and Verizon (VZ), have significant network deployment under the 1 GHz band. Consequently, Sprint’s cost structure should be higher than the two largest US telecom companies.

Sprint acknowledged the cost advantages and quicker deployments associated with networks in low band spectrums in a letter to the Federal Communications Commission (or FCC) in February 2014. Please read Why spectrum is the lifeblood of a wireless network to learn more about spectrums in the US telecom space.

Sprint is cutting down on its operating costs as well as selectively expanding its deployments in new locations to manage these high capital expenditures. However, marginal cash flows aren’t alleviating Sprint’s liquidity concerns.

Sprint’s liquidity pressures

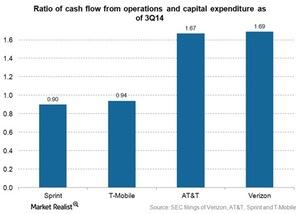

As you can see in the above chart, Sprint had the lowest cash-flow-to-capital-expenditure ratio among its peers in the last quarter. Sprint’s (S) and T-Mobile’s (TMUS) ratios were lower than one for the quarter.

A ratio lower than one indicates that the telecom company is not able to make capital investments by the cash it’s generating from its ongoing business. Only AT&T and Verizon were funding their capital investments through ongoing business operations.

If you want to have a diversified exposure to both of these telecoms, you can invest in the SPDR Technology Select (XLK). The ETF held a total of ~9.4% in these two telecoms at the end of January 2015.