Yum! Outperforms Analysts’ Same-Store Sales Growth Estimates

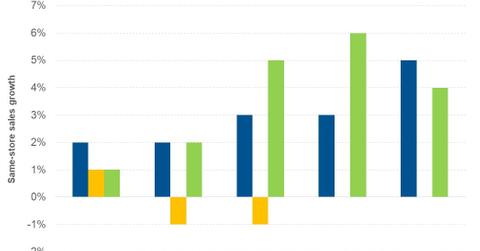

Yum! Brands (YUM) posted overall SSSG (same-store sales growth) of 4.0% in the first quarter of 2019, outperforming analysts’ estimate of 2.7%.

May 2 2019, Published 3:33 p.m. ET

First-quarter performance

Yum! Brands (YUM) posted overall SSSG (same-store sales growth) of 4.0% in the first quarter of 2019, outperforming analysts’ estimate of 2.7%.

Let’s take a look at the SSSG of Yum! Brands’ three brands.

KFC

KFC posted SSSG of 5.0% in the first quarter, outperforming analysts’ estimate of 2.7%. KFC’s SSSG was driven by its strong performances in Japan, Indonesia, Australia, Africa, and China. The brand posted SSSG of 15%, 12%, 10%, and 6%, respectively, in Japan, Indonesia, Africa, and Australia.

In the United States, KFC’s SSSG came in at 2.0%. The brand’s expansion of its delivery service to a greater number of restaurants, its menu innovations, and its distinctive marketing campaign drove its SSSG. In association with Grubhub, KFC had expanded its delivery service to 2,200 KFC restaurants at the end of the first quarter of 2019. Also, 3,200 of its restaurants offered a click-and-collect service on the Grubhub marketplace.

Pizza Hut

Pizza Hut’s SSSG was flat in the quarter, falling short of analysts’ expectation of 0.5%. To drive its SSSG, Pizza Hut continued to offer compelling value with its $7.99 large two-topping pizza deal and its $5 Lineup Menu. Yum! Brands’ partnership with Grubhub also provided Pizza Hut with an opportunity to expand its sales channels.

Taco Bell

Taco Bell posted SSSG of 4.0%, lower than analysts’ estimate of 4.5%, in the quarter. The brand posted impressive SSSG of 5.0% in the United States. During the quarter, it continued with its value offerings by introducing the $1 Grande Burrito and the Double Cheesy Gordita Crunch Box. It also reintroduced Nacho Fries in the quarter, which resonated well with customers. The official launch of its delivery service and the associated marketing campaign also helped the brand post strong SSSG in the period.

After the success of value boxes in the United States, Taco Bell introduced them in international markets. The introduction of the Stacker Box for five British pounds in the United Kingdom and the Big Bell Box in India helped drive Taco Bell’s sales during the quarter.

Peer comparison

During the comparable quarter, Domino’s Pizza (DPZ) posted SSSG of 3.9% in the United States and 1.8% internationally.