Possible Acquisition: Why Is Kroger Interested in The Fresh Market?

The Kroger Company (KR) might be seeking to acquire The Fresh Market (TFM). The Fresh Market’s (TFM) stock rose ~22% on Thursday, February 11, 2016, after the news of Kroger’s bidding hit the market.

Feb. 16 2016, Updated 12:05 p.m. ET

Kroger’s interest in The Fresh Market

According to a report by Reuters on February 11, 2016, The Kroger Company (KR) might be seeking to acquire The Fresh Market (TFM). While neither Kroger nor The Fresh Market confirmed the news, Reuters claims that the two companies are in the second round of the auction process. Apollo Global Management, KKR & Co., and TPG Capital are some of the other reported participants.

The Fresh Market’s (TFM) stock rose ~22% on Thursday, February 11, 2016, after the news of Kroger’s bidding hit the market. Investors looking for exposure to The Fresh Market (TFM) can invest in the SPDR S&P Retail ETF (XRT) and the Barron’s 400 ETF (BFOR). XRT invests 1.1% of its holdings in TFM, and BFOR invests 0.27% of its holdings in TFM.

TFM had already given hints about the sale

The Fresh Market had announced in October 2015 that it was conducting a strategic review of its operations that could result in a possible sale of the company or a change in its capital structure. The company has been facing slowing sales due to rising competition from traditional retail chains such as Kroger (KR), Walmart (WMT), and Costco (COST). Expansion by Sprouts Farmers Market (SFM) and Trader Joe’s in TFM’s territories pose another threat to the company.

Kroger’s mergers and acquisitions spree

Kroger has been quite active in identifying cheaply valued grocery companies that can enhance its top line. Its recent acquisitions include Roundy’s, Vitacost.com, and Harris Teeter. You can read more on Kroger’s recent acquisitions in Part 3 of this series.

What does Kroger get from TFM?

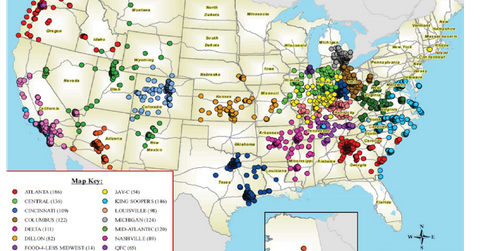

Kroger has a presence across 35 states and operates around 2,774 grocery retail stores (as of December 18, 2015) under nearly two dozen banners.

The acquisition of The Fresh Market would add another 180 stores to Kroger’s portfolio across 27 states. It would increase Kroger’s presence mainly in Florida and North Carolina, where TFM has 40 and 20 stores, respectively. Part 3 of this series talks about the stores of Kroger and TFM in greater detail.

In the next part of this series, we’ll look at TFM’s sales and profitability in greater detail.