An Overview of the South African Economy’s Structure

The finance sector here consists of finance, real estate, and business services. The South African economy depends heavily on the manufacturing sector.

Jan. 18 2016, Published 9:34 a.m. ET

Introduction

We will be bringing in-depth analysis of three Africa-focused funds, namely the Commonwealth Africa Fund (CAFRX), the T. Rowe Price Africa & Middle East Fund (TRAMX), and the Nile Pan Africa Fund – Class A (NAFAX). All three funds have a major regional exposure to South Africa. So, it would be helpful for the investors of these funds to be aware of the country’s macroeconomic scenario. The aim of this series is to give a brief overview of the structure of the South African economy and also discuss some key macroeconomic indicators.

We’ll discuss the following four major points:

- the structure of the economy

- GDP (gross domestic product) growth

- unemployment

- inflation

The economy’s structure

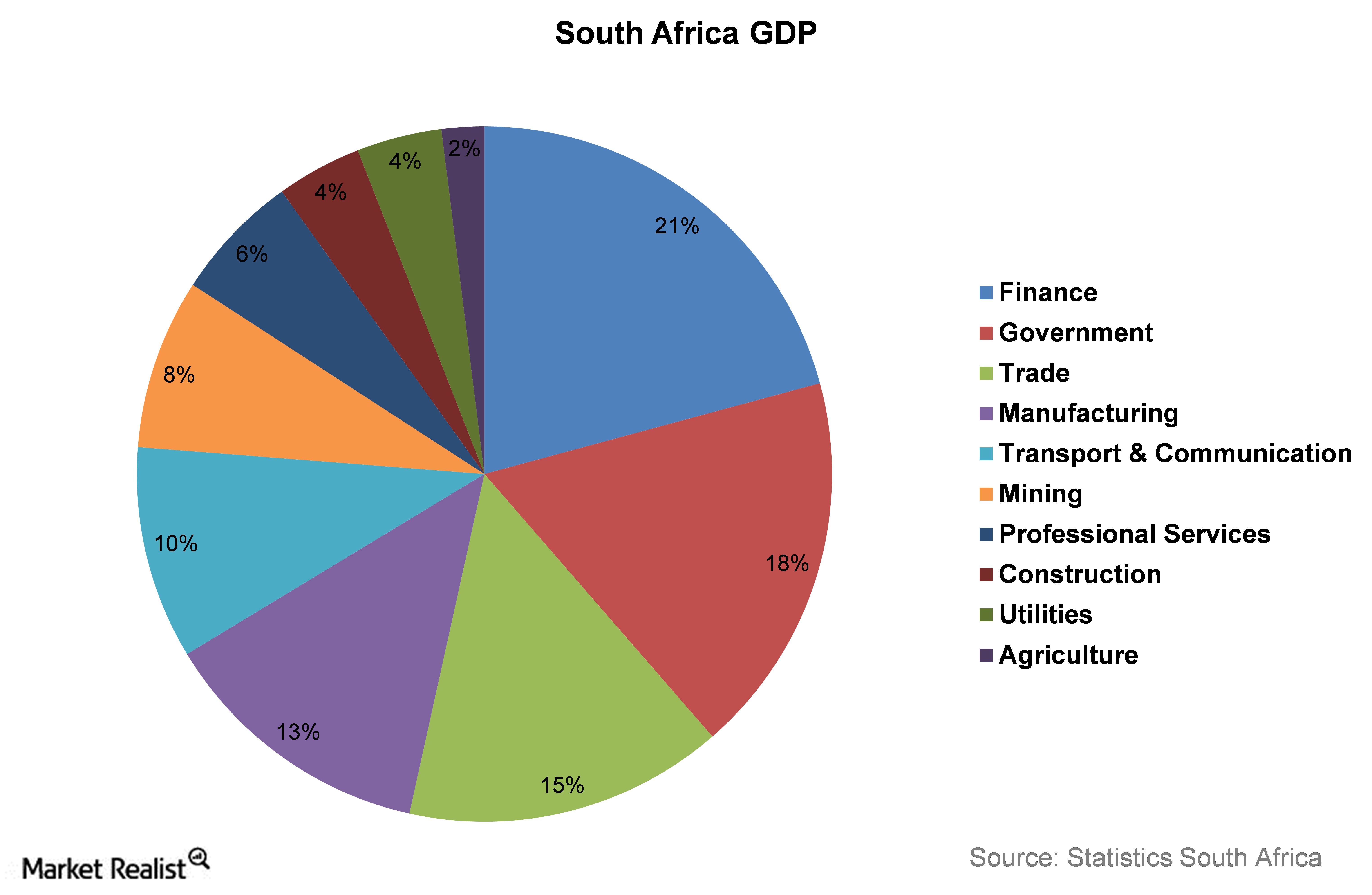

The nominal GDP for 3Q15 was estimated at 1 trillion South African rand (equivalent to $60 billion). The chart above shows the sector-wise contributions to the nominal GDP. Note that the nominal GDP of a country is computed at the current price levels. Unlike real GDP, the nominal GDP isn’t adjusted for inflation.

The finance sector in the chart above consists of finance, real estate, and business services. The South African economy depends heavily on the manufacturing sector that forms 13.3% of its GDP. The manufacturing sector also provides the largest workforce among all sectors. We’ll look at the sector-wise employment in Part 3 of this series.

South Africa faced challenges in electricity shortages in 2015. While electricity generation (SSL) fell by 1.5%, electricity distribution fell by 2.5%. This has led to sharp inflation in the energy sector. Mining (AU) (GFI) forms 8% of the economy.

In the next article, we’ll look at the GDP growth rate and industry-wise contribution to GDP growth in 2015.