An Investor’s Guide To China’s Shadow Banking System

China’s shadow banking includes the trust sector, the off balance sheet lending by commercial banks, and financing vehicles of commercial banks.

Dec. 25 2014, Updated 1:25 p.m. ET

China’s banking regulations

In order to curb speculation in the banking sector, China changed its banking regulations over the past decade. Let’s discuss some of the following key changes.

- Tightening norms for second home loans. China raised the loan-to-value ratio, which increases the initial down payment for buying a home to more than 50% for a second home. It also increased the sale lockup period from two years to five years.

- Restrictions on real estate companies. China barred the use of IPO (or initial public offering) proceeds to buy land. This, coupled with credit tightening from the commercial banks, handicapped the local real estate companies.

Emergence of shadow banking

With normal financing channels not available for their funding needs, real estate companies turned to what is now referred to as shadow banking. The term shadow banking was first introduced by economist Paul McCulley in 2007.

Components of China’s shadow banking

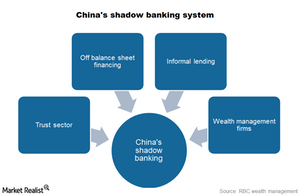

According to a report from the Royal Bank of Canada (or RBC), China’s shadow banking includes the trust sector, the off balance sheet lending by commercial banks, and financing vehicles of commercial banks. It also includes informal lending between two discrete parties, innovative wealth management products from wealth management firms, and certain other channels. The chart above shows the various components of China’s shadow banking.

Investors in steel plays such as ArcelorMittal (MT), AK Steel (AKS), U.S. Steel Corporation (X), and Steel Dynamics (STLD) should watch China’s banking regulations closely. The SPDR S&P Metals and Mining ETF has invested in some of these companies.

Recently, China eased some of its banking regulations to bail out the real estate sector. We’ll analyze the new regulations in our next part.