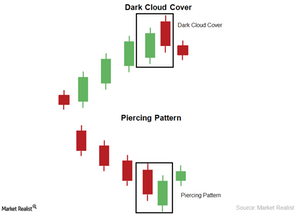

Dark Cloud Covering And Piercing Candlestick Pattern

The Piercing candlestick pattern is a reversal pattern. The pattern has two candles. The first candle is bearish. The second candle is bullish.

Nov. 27 2019, Updated 7:20 p.m. ET

Dark Cloud Cover candlestick pattern

The Dark Cloud Cover candlestick pattern is a reversal pattern. The pattern has two candles. The first candle is bullish. The second candle is bearish. In this pattern, the second candle opens above the first candle’s close. The second candle closes below the middle of the first candle. This pattern forms due to indecision in buying and selling activity in the stock market.

Piercing candlestick pattern

The Piercing candlestick pattern is a reversal pattern. The pattern has two candles. The first candle is bearish. The second candle is bullish. In this pattern, the second candle opens below the first candle’s close. The second candle closes above the middle of the first candle. This pattern forms due to indecision in buying and selling activity in the stock market.

When the Dark Cloud Cover pattern forms, investors must wait and see the next price movement. If the next candlestick is a bearish candle, it can be used as an exit point. When the Piercing patterns forms, if the next candlestick is a bullish candle, it can be used as an entry point. However, many traders use a combination of patterns and indicators for entry and exit.

Key stocks with these patterns

Recently, we’ve seen the Dark Cloud Cover pattern in Baidu Inc. (BIDU), Anworth Mortgage Asset Corp. (ANH), and Education Realty Trust (EDR). In contrast, Paychex Inc. (PAYX) and Ann Inc. (ANN) are showing the Piercing pattern.