Alcoa Beats Wall Street Expectations Again

Aluminum premiums more than doubled in 2014, which benefited primary producers like Rio Tinto and BHP Billiton.

Nov. 20 2020, Updated 1:13 p.m. ET

Alcoa 4Q14 earnings per share

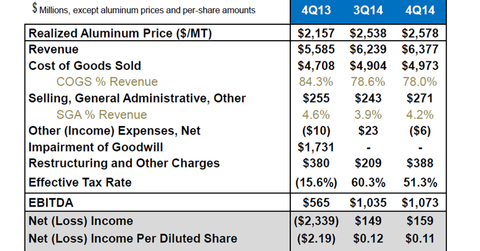

Let’s explore Alcoa’s (AA) 4Q14 results in detail. Alcoa reported revenues of $6.4 billion in 4Q14, which is 14% higher than the company’s reported revenues in 4Q13. The earnings per share (or EPS) before extraordinary items is 33 cents per share. However, the EPS stands at 11 cents after taking into account extraordinary items. With these results, Alcoa beats Wall Street expectations for earnings.

Extraordinary expenses

Alcoa’s ongoing portfolio transformation accounts for the company’s extraordinary expenses, which totaled $273 million in 4Q14. Even in 3Q13, Alcoa had restructuring charges of $209 million, resulting from Alcoa’s idled smelting plants in Italy and Australia.

We will explore these special items and their impact on investors later in this series.

Alcoa’s 4Q earnings

The above chart shows the summary of Alcoa’s 4Q financial results. The realized aluminum prices increased ~20% year-over-year, largely due to a spike in aluminum premiums in 2014. Aluminum premiums more than doubled in 2014, which benefited primary producers like Rio Tinto (RIO) and BHP Billiton (BHP). The SPDR S&P Metals and Mining ETF (XME) seeks to build a diversified portfolio that includes these companies. Allegheny Technologies (ATI), a top holding of XME, is a leading producer of specialty metal products.

Firth Rixson revenues

The 4Q financial results include the revenues from Firth Rixson. Alcoa completed the acquisition of this global jet engine component firm toward the end of November 2014.

In the next section, let’s explore more about the special items that Alcoa reported in 4Q14.