Inside China’s Emerging Market Opportunities

To gain an understanding of the latest changes in emerging markets—in particular those changes related to China, the largest emerging markets country—we spoke with Vanguard’s head of ETF Product Management, Rich Powers.

Nov. 15 2017, Updated 3:11 p.m. ET

The investment world is expanding into more regions and deeper into countries that are modernizing their markets. To gain an understanding of the latest changes in emerging markets—in particular those changes related to China, the largest emerging markets country—we spoke with Vanguard’s head of ETF Product Management, Rich Powers.

Can you start by helping us better understand the differences between emerging markets and developed markets?

Absolutely. The major index providers have robust, though sometimes differing, lists of criteria with which to classify countries as developed or emerging. These criteria may include GDP per capita and other measures of economic health, as well as indicators of a healthy market infrastructure, such as investor rights, openness, transparency, and regulation. Index providers are transparent in publishing these criteria online.

Individual companies are then included in the developed or emerging index that includes their country of domicile or listing, no matter how large or “advanced” the company may be. Stock markets in emerging countries typically are less open, transparent, or regulated and historically have been more volatile, since there generally have been more instances of geopolitical risk or economic turbulence.

What have been some major changes in emerging markets recently?

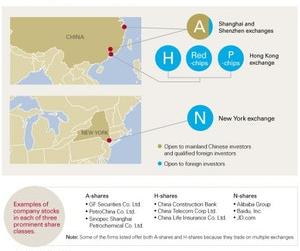

The big news in emerging markets has been the continued opening of the mainland Chinese stock markets to foreign investment. China A-shares, sold on the mainland, traditionally had been available for purchase only by Chinese citizens. Chinese regulators want more foreign capital in their markets, and they are, more and more, opening up the Shanghai and Shenzhen exchanges to foreign investors through several pathways, such as the Qualified Foreign Institutional Investor and Renminbi Qualified Foreign Institutional Investor programs. That is a significant and historic change.

China A-shares have been included in some indexes for a few years now. FTSE Emerging Markets All Cap China A Inclusion Index—the market-capitalization-weighted benchmark of Vanguard Emerging Markets Stock Index Fund, including its ETF share class (Vanguard FTSE Emerging Markets ETF, VWO)—transitioned into A-shares beginning in 2015.

More recently, another large index provider, MSCI, has decided to add some China A-shares in its comparable emerging markets index, and FTSE has decided to expand its emerging markets index to include other types of Chinese shares, known as N-shares and S-chips, in September.

Emerging markets investors already had access to Chinese companies through Hong Kong. Why is it important to add in these other types of shares?

China has the world’s second-largest GDP. It accounts for 20% of global trade and 7% of global consumption. It has the second-largest stock market in the world by market cap.1 Adding in the other types of shares provides a more accurate reflection of the Chinese market. The Chinese market is not fully open to foreign investment, but to the degree that it is, an emerging markets index, and products that track it, should reflect that.

In short, the world we can access is getting broader while the costs to invest are getting lower. Why not increase exposure to that? We believe that diversification reduces risk per unit of return.2

How do index providers construct their indexes using Chinese shares?

When weighting for market cap, index providers take into account not only the percentage of shares available to the public but also the percentage of shares available to foreign investors. Index providers, however, take differing views on types of shares, countries, or even individual companies. Tangible differences in indexes can lead to differences in performance for products that track those indexes.

Right now, the FTSE Emerging Markets All Cap China A Inclusion Index provides a 29% weight to Chinese stocks. That currently includes about 5% to China A-shares. If the full market cap of China’s A-shares and other types of Chinese shares were included, China would make up 50% of the emerging markets index.3 That’s a lot, and we’re a long way from that happening. If Chinese markets were fully open to foreign investment, then I would think index providers would move toward a full market-cap representation of the Chinese equity market.

Why does China have all these types of shares?

Stock trading is not new to China. The Shanghai Stock Exchange opened in 1890, although it wasn’t until much later that the Chinese stock markets evolved into international players. Red-chips, which are shares of state-owned enterprises, were first listed in Hong Kong in 1972. In 1990, the Shanghai exchange was reconstituted using A-shares. After that came N-shares, which are Chinese companies listed on New York exchanges, as well as H-shares and P-chips in Hong Kong and S-chips in Singapore. There are nuances to each. P-chips, for example, are private companies incorporated in foreign jurisdictions, such as the Cayman Islands or Bermuda.

A-shares are a more diversified market that better reflect the Chinese economy. H-shares tilt more heavily to financial companies.4

How does Vanguard Emerging Markets Stock Index Fund aim to provide emerging markets exposure?

In every Vanguard product, we try to be as broadly diversified as possible in the specific segment of the market being targeted and to offer that product at a low cost. This fund is no exception. We feel this index and our fund that tracks it are pure reflections of emerging markets countries and the companies headquartered in those countries.

Additionally, because we were early adopters of China A-shares and shares of smaller Chinese companies, we are a bit ahead of where other index fund managers, and index providers, appear to be headed. That may mean our investors are less apt to experience the costs of this transition to China A-shares and are more experienced in trading in the market.

Is there a target allocation that advisors might aim for with their clients’ portfolios?

Emerging markets make up 20% of international equities based on market cap. So we recommend that as a starting point. To the extent that advisors, or their clients, have a view on the attractiveness or volatility of emerging markets, then they can adjust [their allocations] accordingly as an active decision. It’s probably best not to ignore emerging markets. Those countries, including China, may have a big impact on global economic growth in the coming years and decades.

1. International Monetary Fund, World Trade Organization, and World Bank.

2. Valley Forge, Pa.: The Vanguard Group., 2017. Vanguard’s framework for constructing diversified portfolios. Accessed August 24, 2017.

3. FTSE Russell, 2015. FTSE starts transition to include China A Shares in global benchmarks. (Press release.) Accessed August 8, 2017.

4. FTSE Russell, 2016. China through the mosaic of its share classes. Accessed August 3, 2017.

Notes:

- Vanguard ETF Shares are not redeemable with the issuing Fund other than in very large aggregations worth millions of dollars. Instead, investors must buy and sell Vanguard ETF Shares in the secondary market and hold those shares in a brokerage account. In doing so, the investor may incur brokerage commissions and may pay more than net asset value when buying and receive less than net asset value when selling.

- Past performance is no guarantee of future results.

- All investing is subject to risk, including possible loss of principal.

- Diversification does not ensure a profit or protect against a loss.

- Investments in stocks issued by non-U.S. companies are subject to risks including country/regional risk and currency risk. Stocks of companies based in emerging markets are subject to national and regional political and economic risks and to the risk of currency fluctuations. These risks are especially high in emerging markets.

London Stock Exchange Group companies includes FTSE International Limited (“FTSE”), Frank Russell Company (“Russell”), MTS Next Limited (“MTS”), and FTSE TMX Global Debt Capital Markets Inc. (“FTSE TMX”). All rights reserved. “FTSE®”, “Russell®”, “MTS®”, “FTSE TMX®” and “FTSE Russell” and other service marks and trademarks related to the FTSE or Russell indexes are trademarks of the London Stock Exchange Group companies and are used by FTSE, MTS, FTSE TMX and Russell under license. All information is provided for information purposes only. No responsibility or liability can be accepted by the London Stock Exchange Group companies nor its licensors for any errors or for any loss from use of this publication. Neither the London Stock Exchange Group companies nor any of its licensors make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to the results to be obtained from the use of the FTSE Indexes or the fitness or suitability of the Indexes for any particular purpose to which they might be put.