Why the software industry commands high margins

Major contributors to the operating expenditure are marketing costs and research and development (R&D) expenses that leads to value added products and services development.

July 7 2014, Published 9:00 a.m. ET

Software industry and high margins

The software industry has long been associated with high margins. Even during the slowing down of economy, this industry has managed to stay afloat. The high margin gives it a competitive advantage to survive in hard times.

Oracle commands the highest margins in the industry

The previous graph shows the earnings before interest, taxes, depreciation, and amortization (or EBITDA) margins of leading players. Microsoft is the market leader in the industry on revenue basis. However, when it comes to the “margin” front, Oracle seems to have taken the title. For the past three years, its margins have shown continuous improvement.

Recurring revenues leads to increased confidence and visibility

Software companies sign multi-year contacts with their customers. The established client base provides them recurring revenues in the form of maintenance, updates, customization, and other services because most of the software programs need support, maintenance, and upgradation. Recurring revenues aid in increased visibility of future revenues. Maintenance contracts provide the support to licenses. They’re usually valid for three to four years. Leading players enjoy high renewal rates that explain the margins that they enjoy.

High margin and low asset intensity leads to high ROE

Major contributors to the operating expenditure are marketing costs and research and development (R&D) expenses that leads to value added products and services development. The software industry is highly dependent on intellectual capital. Not many fixed assets beyond furniture and computers are required for it to function. Although the industry’s R&D costs and marketing costs are very high, its operating costs are relatively low. The software programs are reproducible at very low costs relative to its production costs, which consequently leads to high margins. This enables them to generate revenues without substantially increasing their costs and achieve profitability in short time. As a result, low asset intensity and high margins result in high return on equity (or ROE) for the software industry.

High dividends

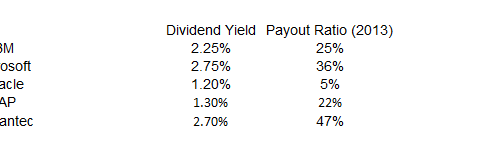

The data above shows the high dividends of leading players.

Microsoft (MSFT), IBM Corp. (IBM) and SAP AG (SAP) hold a monopolistic or dominant presence in their respective markets, but they don’t enjoy high growth. Other players include Oracle (ORCL) and Symantec (SYMC). Over time, they have reached a maturity stage. However, it’s their market dominance and high margins that generate steady huge cash flows that they share with their investors and shareholders in form of steady dividends. As they establish market share, they’re considered less risky. As a result, they’re able to command high valuations.