Must know: How credit rating affects default rate and bond price

A lower credit rating means higher risk, and therefore, higher yield as investors look for the premium to take the risk and vice versa.

Nov. 26 2019, Updated 8:49 p.m. ET

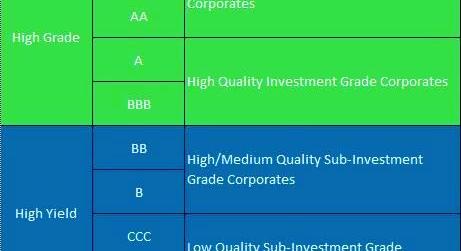

Credit ratings assess the credit-worthiness of a borrower and assign a grade based on the borrower’s business operation and financial stability. In the U.S., there are three major credit rating agencies—S&P, Moody’s, and Fitch.

Credit rating and yield relationship are inversely proportional by nature. A lower credit rating means higher risk, and therefore, higher yield as investors look for the premium to take the risk and vice versa. Credit risk premium is the spread between the U.S. Treasury and other fixed income investments. The majority of defaults are preceded by downgrades to the issuer’s credit rating. As a result, a warning usually precedes most defaults, though by the time the company defaults the price of the bond has tumbled significantly.

For instance, the rating agency may downgrade a bond’s or a loan’s rating from BBB to BB because of fall in debt repayment ability, for example, deterioration in interest coverage ratio. This will increase the bond’s yield substantially and its price will fall. In this particular case, the bond will go from investment-grade to below investment-grade, which will force many pension funds to sell the bond since some may only be allowed to hold investment-grade securities; this will put more pressure on the bond’s already low price.

Now, we will try to look at how rating agencies look at default risk in quantitative terms, based on probability of default and loss given default. Default rate is derived from a combination of default probability and loss on default. The probability of default (or PD) and loss given default (or LGD) associated with high yield bonds is indeed much higher than what’s associated with other asset classes. The probability of default is essentially the likelihood of the issuer to default. Loss given default assessments are opinions about expected loss given default on fixed-income obligations. They’re expressed as a percentage of principal and accrued interest at the time of default.

During the first 3 quarters of 2013, high yield issuers have experienced more downgrades than upgrades. During this period, downgrades have accounted for 54% of Moody’s sub-investment grade ratings actions. This compares to 48% and 51% in 2011 and 2012, respectively.